The US stock market is looking wobbly again, but you wouldn’t know it by reviewing the trend in utility stocks. This interest-rate sensitive slice of equities continues to dominate the sector horse race, based on a set of proxy ETFs.

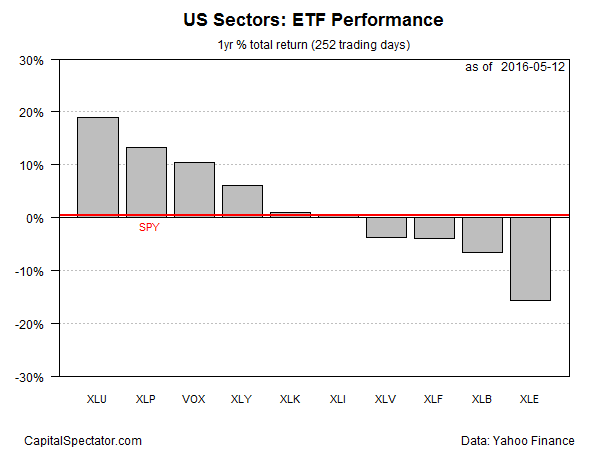

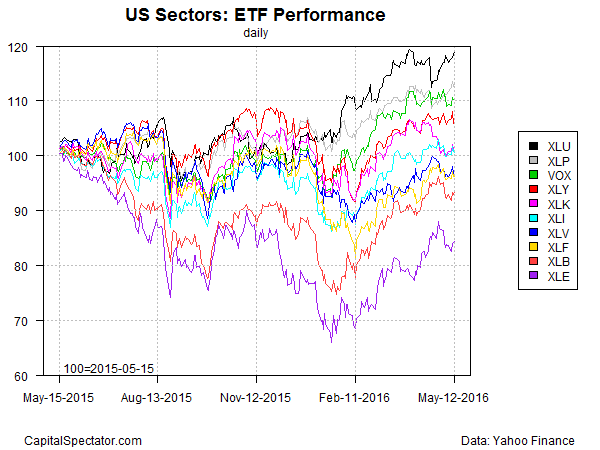

The Utilities Select Sector SPDR ETF (XLU) is firmly in the lead so far this year through May 12 among the main US sectors. The ETF is sitting on a strong 15.5% total return year to date and is higher by nearly 18% for the trailing one-year period.

XLU’s bull-market bias looks good in absolute and relative terms. Indeed, the recent gains for the US market overall have dwindled to a crawl lately. The SPDR S&P (SPY) is ahead on a year-to-date basis by a thin 1.8%; for the past year, SPY’s total return fades to just 0.5%.

The sector realm’s perennial loser of recent years—energy—is looking firmer in 2016. After bottoming in late-January, the Energy Select Sector ETF (XLE) has mounted a solid rebound and is currently higher by nearly 10% year to date—second only to XLU for 2016 total returns among US sector ETFs. But the recovery for the energy fund still has a long way to go to bring its one-year total return back into the black. XLE remains dead last for the trailing 12-month period, nursing a 15.8% loss vs. the year-earlier price.

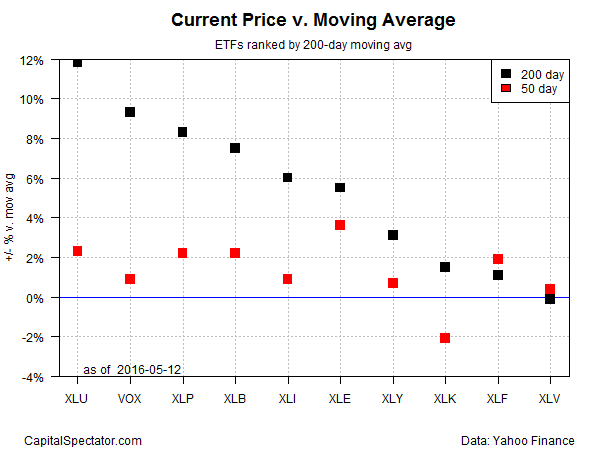

Despite the recent turbulence in the broad market, most sector funds continue enjoy a favorable momentum profile. As the next chart below shows, eight of the ten sector ETF prices (as of May 12) are above their 50- and 200-day averages at the moment. The exceptions: technology (XLK) and health care (XLV), which post mixed profiles.

Leave A Comment