Several months ago I reviewed the case for thinking that the long-suffering value factor for US equity investing was in the process of reviving. At the time, the evidence was sketchy but the outlook was encouraging. Fast forward to early August and the bullish trend looks a bit stronger for this corner of equities.

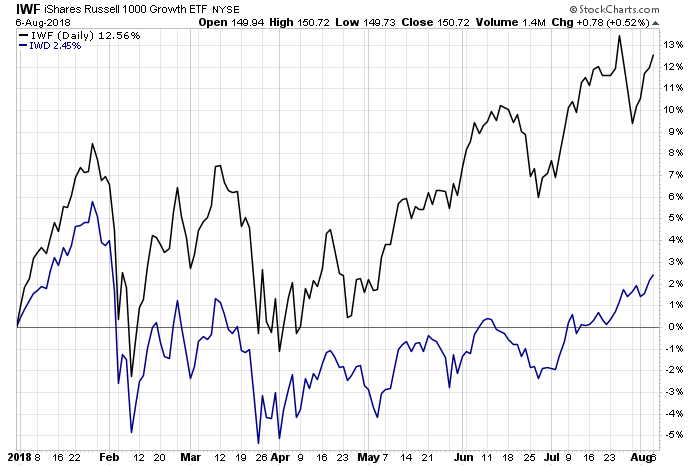

All the usual caveats apply, of course, but the fact that the upward bias for the value factor is intact is a positive if preliminary sign. Consider, for example, how a pair of ETFs representing a large-cap value portfolio (iShares Russell 1000 Value (IWD)) and its growth counterpart (iShares Russell 1000 Growth ETF (IWF)) have fared this year. Although growth retains a wide lead over value year to date, it’s notable that value’s recent underwater performance in 2018 has given way to a modest gain through yesterday’s close (August 6).

It’s premature to read too much into value’s modest rally of late, but for the year IWD is up 2.5%. Perhaps more importantly, value’s nascent bull run in positive terrain in 2018, fragile though it may be, has been ongoing for nearly a month. Measured from the recent bottom in the spring, IWD’s revival looks even stronger.

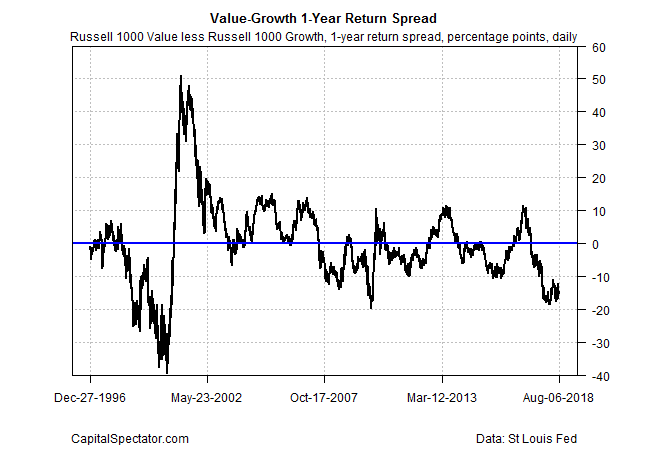

Nonetheless, value’s latest pop still leaves the risk factor’s performance deep in the red vs. growth, as defined by the rolling one-year return spread for the Russell 1000 Value Index less Russell 1000 Growth. Indeed, value is currently behind growth by roughly 15 percentage points for the trailing one-year window – close to its deepest relative setback since the last recession ended.

The key takeaway: there’s still a long road ahead for value’s revival, at least if you’re keeping score by way of growth’s relative performance.

By some accounts, however, the recovery may soon run out of road. “We see a stronger macro case for the yield curve to continue its flattening trend which is likely to be a headwind for further value out performance if this relationship holds,” warns Mayank Seksaria, chief macro strategist at Macro Risk Advisors..

Leave A Comment