Florida-based cigarette maker Vector Group (NYSE: VGR) is set to sell US$325m worth of senior unsecured notes to refinance existing bonds, as the company continues to struggle with a hefty debt burden.

Vector Group, parent of tobacco company Liggett, as well as New Valley, which owns a majority stake in Douglas Elliman Realty, plans to enter the primary market with a Rule 144A private placement, Reg S sale – an offering solely intended for qualified institutional buyers and persons outside the U.S.

The company said it intends to use the net cash proceeds from the offering to repay its outstanding 7.5% variable interest senior convertible notes due 2019, as well as to pay transaction-related costs and expenses, and for general corporate purposes, including to repurchase its outstanding 5.5% variable interest senior convertible notes due 2020 at, or prior to, maturity.

Moody’s Investors Service assigned a junk-status, ‘B2’ credit rating to the deal and downwardly revised its outlook on the company from stable to negative.

Moody’s analyst Kevin Cassidy recently noted that Vector’s ‘B2’ rating “reflects its relatively small scale and limited pricing flexibility in the deep discount segment of the highly regulated and declining domestic cigarette industry.” He continued that the firm’s credit profile is further constrained by its negative free cash flow and the “ongoing threat of adverse tobacco litigation and regulation.”

Vector’s high pro-forma financial leverage of 6.2x, and continued negative free cash flow in excess of US$100m annually, reflect the company’s high dividend payments.

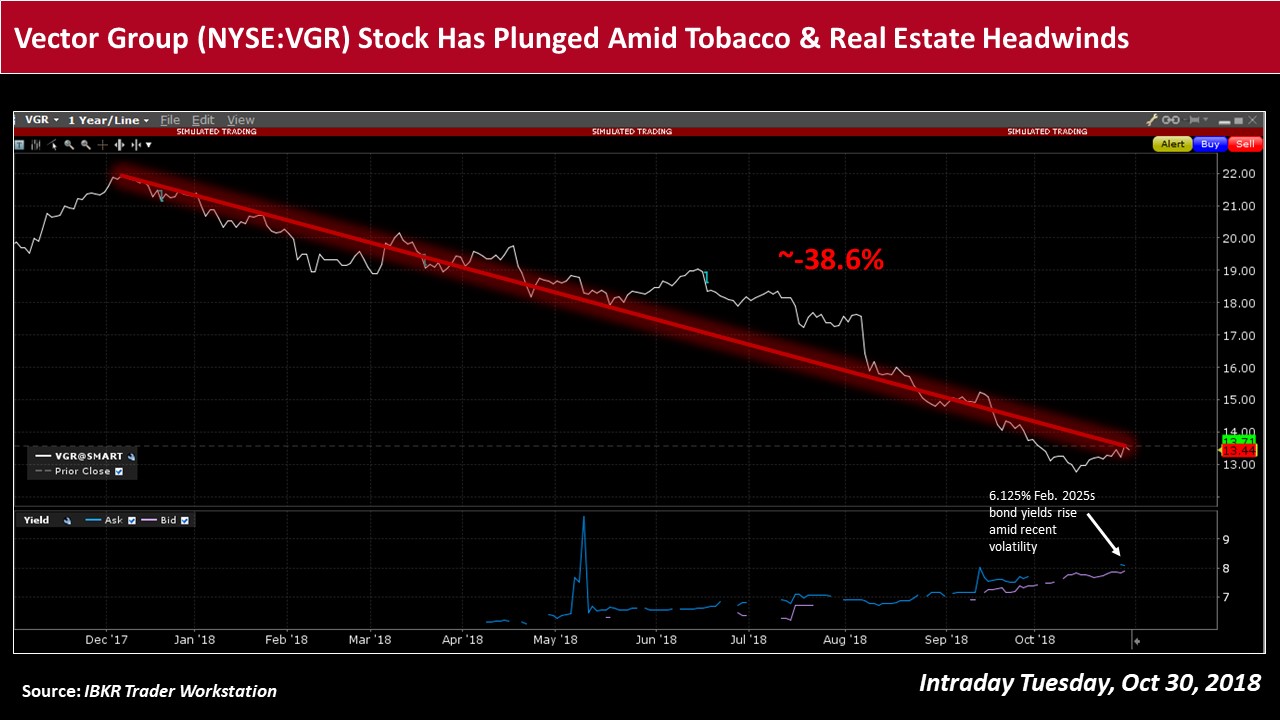

Moody’s said it expects debt to EBITDA to remain high over the next 12-18 months due to modest earnings growth that should help lift the company’s real estate brokerage business that has been under pressure over the past year.

Cassidy added that the ‘B2’ rating on the proposed notes also reflects the benefits from a security interest in the stock of DER Holdings, which holds the company’s 71% interest in the Douglas Elliman real estate brokerage. Moody’s said it expects “this security interest would enhance recovery value in the event of a default,” given the proposed notes are guaranteed on a senior unsecured basis by Vector’s tobacco subsidiaries.

Leave A Comment