One less mainstream piece of this inflation hysteria boom is the velocity of money. In case you haven’t yet heard, monetary velocity is rising. From that we are supposed to infer all the usual – wages, inflation, higher rates, and utter destruction in bonds if not the whole Western economic structure.

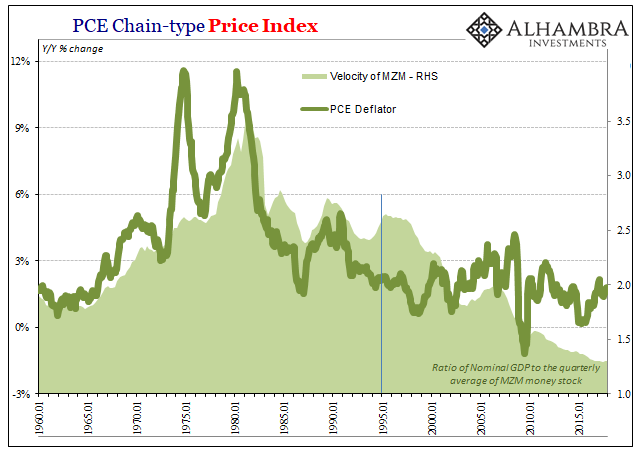

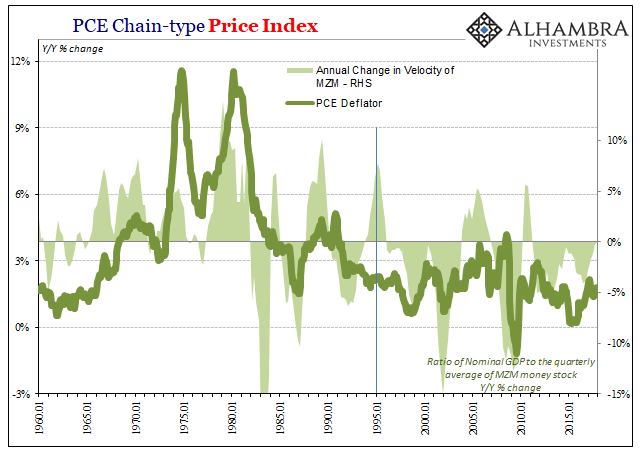

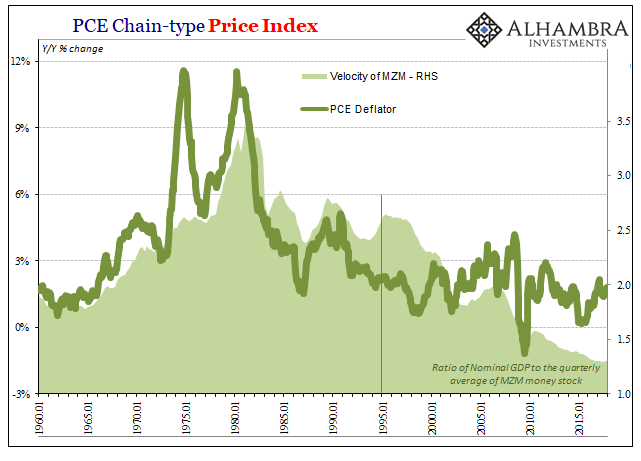

The first part is technically true. Money velocity increased in at least two primary stock indications. Against both M2 and MZM, velocity has accelerated for two straight quarters (through Q4 2017). The former has risen from 1.426 in Q2 2017 to all of 1.431 in Q4; the latter went from 1.295 to 1.299 in those same six months.

Money velocity is, to put it mildly, bunk. Changes in it are in most cases merely functions of accounting. The equation of exchange presumes MV = PQ, and therefore (changes in) V tells us something with regard to (changes in) P. Henry Hazlitt all the way back in 1959 was having none of it:

I have said nothing above about the much-discussed “velocity-of-circulation” of money, and its supposed effect on prices. This is because I believe the term “velocity-of-circulation” involves numerous irrelevancies and confusions. Strictly speaking, money does not “circulate”; it is exchanged against goods.

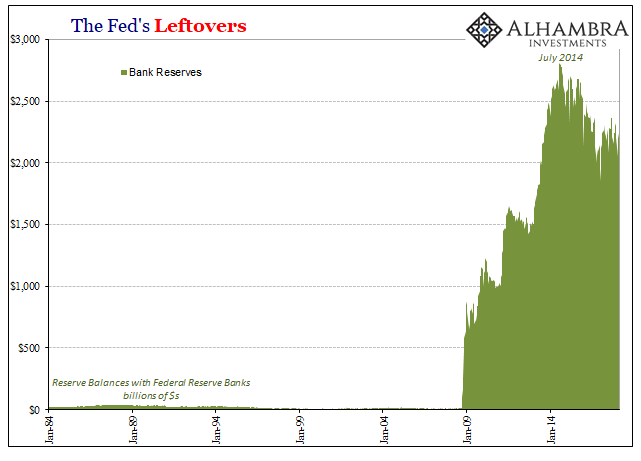

Since 2008 the changes in velocity are explained entirely by either slight increases or decreases in nominal GDP balanced against large increases (or now smaller decreases) in the proportion of whatever stock measurement attributable to the leftovers on the liability side of the Fed’s balance sheet (bank reserves).

In other words, QE1 along with other “emergency” (ineffective) programs started balance sheet expansion, which as an accounting matter vastly increased the level of bank reserves. What didn’t change much, however, was either output or inflation. In fact, any correlation between velocity (MZM; M2 just doesn’t fit at all) and calculated inflation broke apart substantially in the mid-nineties (no surprise that; RiskMetrics and dark leverage).

Leave A Comment