Viewpoint: Astra Asset Management On Credit Markets

June 27, 2023August 21, 2023

Jones

credit, Investment, loans

Astra Asset Management is a London-based investment firm with long-standing experience in corporate credit markets and asset-backed securities; the firm was co-founded by Anish Mathur and Christian Adler more than a decade ago.

In this article, Christian shares his perspective on various instruments available to investors in corporate credit, the relative value between these instruments, and ways Astra captures the value in the current macro-economic environment.

Finding Relative Value in European Corporate Credit

The size and diversity of corporate credit markets mean that there is no shortage of options for investors to express their ideas. In particular, the European bond market emerged from a quieter 2022 with the strongest first quarter since 2009, raising EUR 260bn of corporate debt; high yield issuance was up by more than 20% from Q1 2022.

However, before delving into corporate balance sheets and assessing the credit quality of individual issuers, investors must decide in which form they want to gain exposure: bonds or loans? Investment grade or high yield? What are the pros and cons of selecting individual issuers versus investing in a pool of assets, for example through a CLO? In this blog we review some of these questions (and some related ones) with a focus on the relative value of different approaches.

Senior Unsecured Bonds Versus Leveraged Loans: Pros and Cons

Leaving aside the somewhat archaic settlement process for leveraged loans, bonds differ from loans in at least two important aspects: first, corporate loans are typically senior secured while bonds are unsecured. Accordingly, recovery prospects may vary quite substantially between the two in case something goes wrong. Second, the overwhelming majority of loans is floating rate, in contrast to predominantly fixed rate coupons in the bond market. Depending on one’s view, the shorter interest rate duration of loans may be preferable in a “higher-for-longer” scenario advocated by some members of the FOMC, while bonds’ longer duration might be favoured by investors who consider a fall in long term rates imminent or at least fairly likely in the near future.

A Question of Rating: High Yield or Investment Grade?

One characteristic shared by most leveraged loans and high yield bonds is a credit rating of BB+ or lower; put differently, both asset classes have a greater probability of default compared to credit instruments carrying investment grade ratings (that is, BBB- or better), exposing investors to a higher level of idiosyncratic risk. The latter can be mitigated in two obvious ways, namely by either restricting oneself to highly rated bonds (the availability of IG rated loans in the secondary market is very limited), or by gaining exposure to a pool of credits in a format that provides structural support, including some protection against default of individual underlying assets in the pool; investing in CLOs and their cousins SRTs are examples of the second approach. Either way, there is ample supply of investment grade corporate bonds and CLOs available in both primary and secondary markets.

Putting a Price on it: How The Market Values Different Risks

So far, we have been focussing on qualitative aspects of various credit sectors; to get a more quantitative picture, we will next look at risk premia for various instruments and how they compare to each other. Clearly, financial markets and credit spreads in particular are not stationery, nor are risk premia differentials between various segments of the credit markets. Nevertheless, it is instructive to highlight some recurring themes; let us begin with CLOs and the underlying leveraged loans.

As mentioned, the bulk of syndicated loans are rated below investment grade, more specifically between BB+ and B-; an investor building a portfolio of leveraged loans can expect to earn an average margin of 350-400 basis points above some floating rate benchmark like Euribor. However, the resulting asset pool would be directly exposed to idiosyncratic risk: a default of any of the loans will result in a loss of principal (unless the defaulted loan recovers fully, which is uncommon). Alternatively, one could invest in a CLO tranche, targeting the same rating (that is, BB or B):

- This would typically increase the overall leverage, meaning that an average increase of 1 basis point in the risk premia of the loans comprising the portfolio would result in an increase of the CLO tranche’s credit spread of more than 1 basis point; however,

- Idiosyncratic risk is substantially reduced: the rated debt of a CLO benefits from something like 8% credit support at the outset (in excess of 10% for the BB-rated tranche), and further structural protection over the life of the transaction.

- The yield is significantly higher: currently, European BB CLOs offer margins of around 800 basis points (resulting in double-digit yields including the benchmark rate), and historically risk premia have been well above those for loans through the credit cycle.

If additional leverage is unpalatable or an investment grade rating is preferable, BBB CLOs could be an option:

- These tranches benefit from much greater original subordination – typically around 16% – and are widely considered the “delta one” part of the CLO’s capital structure, so a 1 basis point widening in loan spreads would result in a similar increase in the risk premium for the BBB tranche;

- The risk premium earned is comparable to that of leveraged loans, but given the high level of credit support, idiosyncratic risk is greatly diminished and a loss of principal extremely unlikely. To put things in perspective: individual line items of a CLO portfolio in most cases make up less than 1% of the pool, therefore even under a conservative recovery assumption of 50% it would take more than 30 loans to default for the BBBs to become impaired.

Most CLOs in the market are backed by broadly syndicated loans and are issued to exploit a discrepancy between the income available from the loans and the CLO’s cost of debt. That said, banks also securitise a subset of the loans on their balance sheets to reduce regulatory capital requirements. These transactions – known as SRTs (for “Significant Risk Transfer”) – are typically backed by slightly higher rated loans originating from the institution’s commercial lending activity; however, better collateral quality in many cases goes along with slightly lower yields.

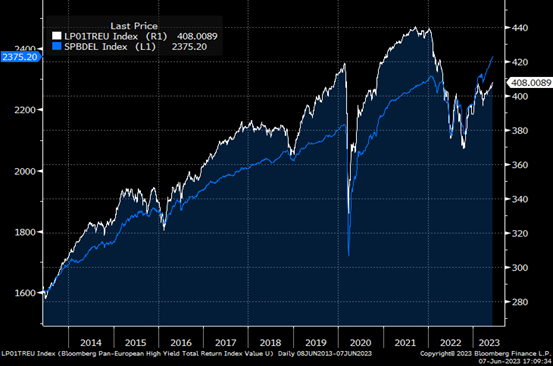

Matters become a bit more involved when one compares loans to high yield bonds, as the latter have a much greater sensitivity to (medium term) interest rates; that said, total returns over the past decade have been broadly similar (white – Bloomberg Pan-European High Yield Total Return Index; blue – Morningstar European Leveraged Loan Total Return Index):

Source: Bloomberg

It remains to be seen whether loans’ recent outperformance proves sustainable or is mostly due to a temporary inversion of the yield curve.

From Hedging Tools to Being an Asset Class: Credit Derivatives

Credit derivatives were first introduced more than two decades ago, originally to offset (or “hedge”) exposures sitting on the balance sheets of large financial institutions and free up credit lines without selling assets to a third party. In due course hedge funds started using these new instruments aptly named credit default swaps to express directional views on individual issuers or to place bets on the relative value of different parts of a company’s capital structure by trading credit default swaps (typically linked to the obligor’s senior unsecured debt) against equity options, capturing a “capital structure arbitrage”.

Indices representing different segments of the corporate credit markets – investment grade, high yield, high volatility, among others – entered the stage in the early 2000s and are widely used today by both banks and asset managers. In Europe, the iTraxx XOver is frequently utilised by banks to hedge the market risk of their European CLO inventory; but it offers investment opportunities to asset managers as well, for example when the spread differential between these instruments deviates significantly from its historical mean. More generally, standardised tranches reflecting different levels of credit risk are available for many of the indices, allowing every investor to gain the exposure most suitable for them.

Conclusion

Credit markets have undoubtedly come a long way over the past two decades and today provide financial institutions and investors alike with a plethora of innovative solutions to meet their needs and achieve their investment targets. But because of its complexity and size the sector remains compartmentalised to a certain degree, frequently resulting in very similar risks being priced inconsistently in different segments; this naturally brings great opportunities for investors who can take advantage of the entire spectrum of available instruments.

Disclaimer

Astra Asset Management UK Limited is authorised and regulated in the UK by the Financial Conduct Authority and by the Securities and Exchange Commission, in relation to US persons only, as a Registered Investment Adviser.

The information in this article is for general information purposes only and does not comprise investment advice or an investment recommendation. It is not (nor is intended to be) particular to any investors’ individual circumstances and does not (nor is intended to) constitute either an offer to buy or sell or a solicitation of an offer to buy or sell any securities, in any jurisdiction. Forward-looking statements are not guarantees of future performance and undue reliance should not be placed on them: the value of an investment may fall as well as rise over time, and there is no certainty of any given return. It is possible to make a significant, including total, loss on any investment. Before making any investment decisions, prospective investors should take such investment, legal, financial, tax and other professional advice they deem necessary. Astra accepts no liability and assumes no duty of care in relation to the information contained in this article.

How to manage your finances in a small business

How to manage your finances in a small business

Dominic Lill

5 tips for surviving the last stretch of the pandemic

5 tips for surviving the last stretch of the pandemic

Dominic Lill

Leave A Comment