Stocks Are Expensive

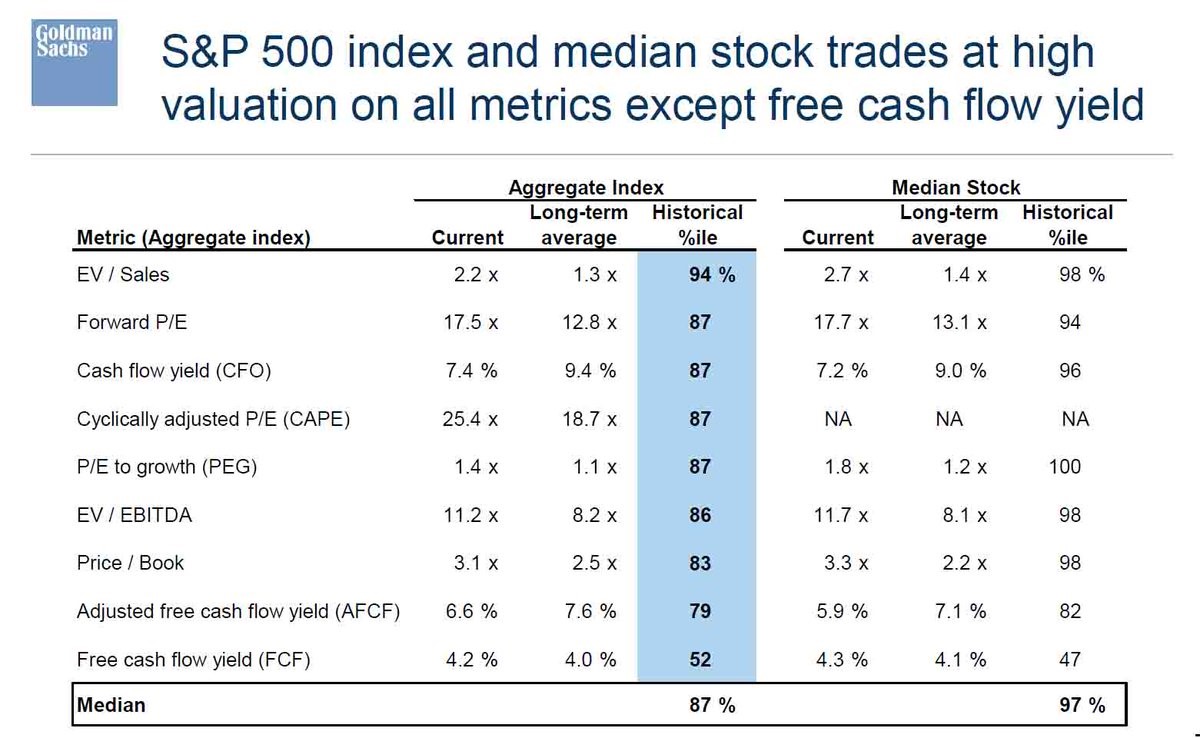

The current market is expensive, but earnings momentum and global growth from the emerging markets are keeping the stock market up. The time the expansion has left is dwindling as the yield curve has been flattening lately. However, the last couple years of gains in a bull market are usually the highest, so that doesn’t mean you want to sell out yet. Having a heightened cash position is logical, but only gradually sell when stocks go up. You can also buy on the next dip. Corrections still happen even though there hasn’t been one this year. To support the concept that the stock market is expensive we have the table below. It shows the latest S&P 500 valuation by looking at the total index and the median stock. As you can see, current valuations are in the 87th and 97th percentile respectively. No one can argue the market has low multiples, but it’s easy to see why stocks will go up in the next few months.

Scary Comparison

The chart below compares the current environment with the 1920s. I am not a fan of comparing current charts with past ones that led to a crash. History rhymes, but it doesn’t repeat. While I think the EPS growth comparison isn’t valid, the bullet points shown are mostly valid. The Fed tightening late in a business cycle isn’t good news. The end of the cycle might occur in the next few years. The earnings comparisons will be tough next year, making the dotted line a possibility It’s just as likely that this guess occurs as the ones which claim the earnings growth will be in the double digits for the rest of eternity. An external shock is possible, but I disagree with the notion that China will cause it. China doesn’t operate with the same capitalist standards that America operates under, so I don’t think the leverage will collapse the way U.S. housing did in 2007. There’s a possibility China’s positive 2017 won’t be repeated, but I don’t see a crash in the cards. Eventually you need to reevaluate the notion of crash when those who have been predicting one have been wrong for several years. If they had been bearish on growth, they would’ve been correct, but they went overboard, predicting a collapse which didn’t happen.

Leave A Comment