Industrial component wholesaler W.W. Grainger (GWW), with 46 consecutive years of rising dividends, is one of the venerable dividend aristocrats.

Even more impressive is that Grainger has rewarded long-term dividend investors with impressive 11.5% annual dividend growth over the last three decades.

Let’s take a closer look at this dividend aristocrat to see whether or not it can continued its long-term double-digit dividend growth in the face of increasing competition from emerging rivals such as Amazon (AMZN).

As importantly, learn whether or not Grainger could be a valuable long-term investment or a value trap with its dividend yield near its all-time high.

Business Overview

Founded in 1927 in Lake Forest, Illinois, W.W Grainger is North America’s largest maintenance, repair, and operator (MRO) parts distributor.

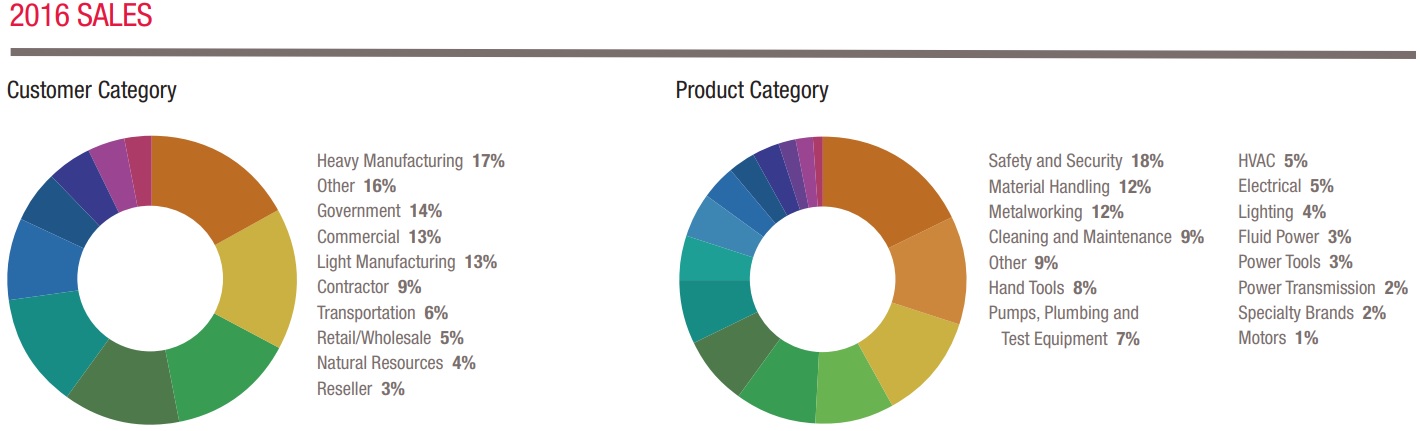

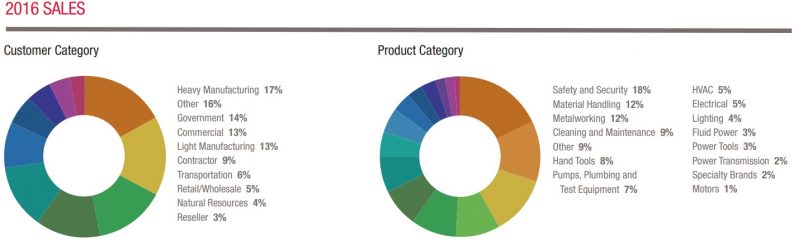

Its 5,100 global suppliers provide the company with about 1.6 million products (e.g. material handling equipment, safety and security supplies, lighting and electrical products, power tools, pumps and plumbing supplies, cleaning and maintenance supplies, building and home inspection supplies, vehicle and fleet components), as well as inventory management systems to more than 3.2 million business, government, and institutional customers around the world.

Source: 2017 Company Factsheet

Grainger operates both through online, e-commerce channels (65% of 2016 sales), as well as nearly 600 global physical stores as of the end of 2016.

Business Analysis

The key to Grainger’s success over the past decades has been its large network effects and massive economies of scale.

Specifically, the company’s massive supply chain and large global distribution network allowed it to become a “one-stop shop” that customers, both large and small, could depend on for reliable, just-in-time delivery of critical components needed to operate their businesses.

With the largest network of distribution centers and store branches in the country, Grainger is strategically positioned with localized inventory that is close to its most important customers.

Being in close proximity to customers helps Grainger deliver products to them very quickly, offer a high quality of service, and keep costs low. Competitors would need to acquire properties in the same service area to compete with Grainger, but they wouldn’t have the established book of business to cover all of their costs.

The mature state of the MRO market makes it very difficult for new players to crack into a geography already covered by a capable distributor, somewhat limiting competition.

Grainger’s scale and inventory assortment are also advantages, especially in the large customer market.

As the largest player in North America, Grainger has somewhat better purchasing power than local or regional distributors. This allows it to offer very competitive pricing for its products, which are generally undifferentiated from one distributor to the next.

Importantly, Grainger’s size also enables it to afford an extremely broad selection of merchandise, making it a one-stop shop for large accounts that are constantly looking to save money by consolidating suppliers.

Grainger’s U.S. catalog offering has grown more than seven-fold from 82,000 SKUs in 2005 to well over half a million SKUs in the latest edition. Impressively, the time a product is in stock has remained at nearly 100% even while increasing the product line substantially.

With thousands of suppliers, this is no small feat. Grainger.com in the U.S. also offers access to more than 1.5 million SKUs.

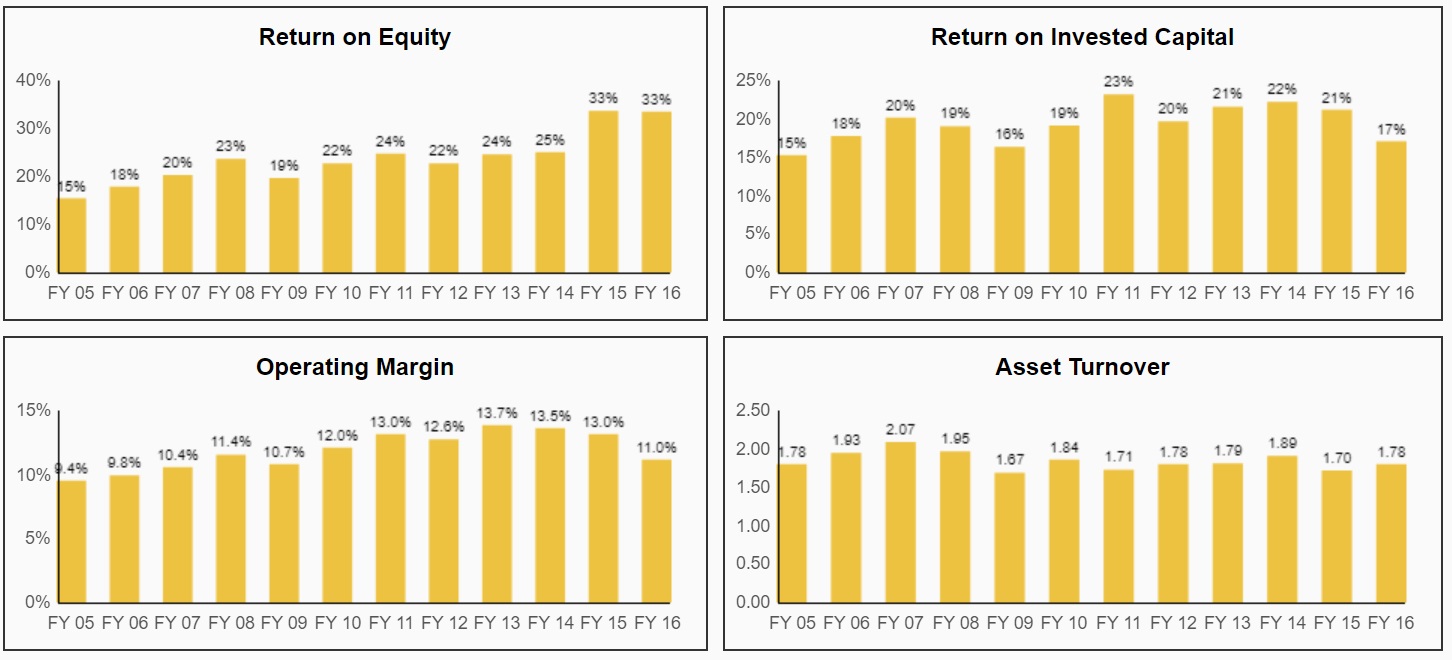

Simply put, Grainger has historically enjoyed a wide moat, which allowed it operate on a business model that included high markups and volume discounts for its largest and most important customers.

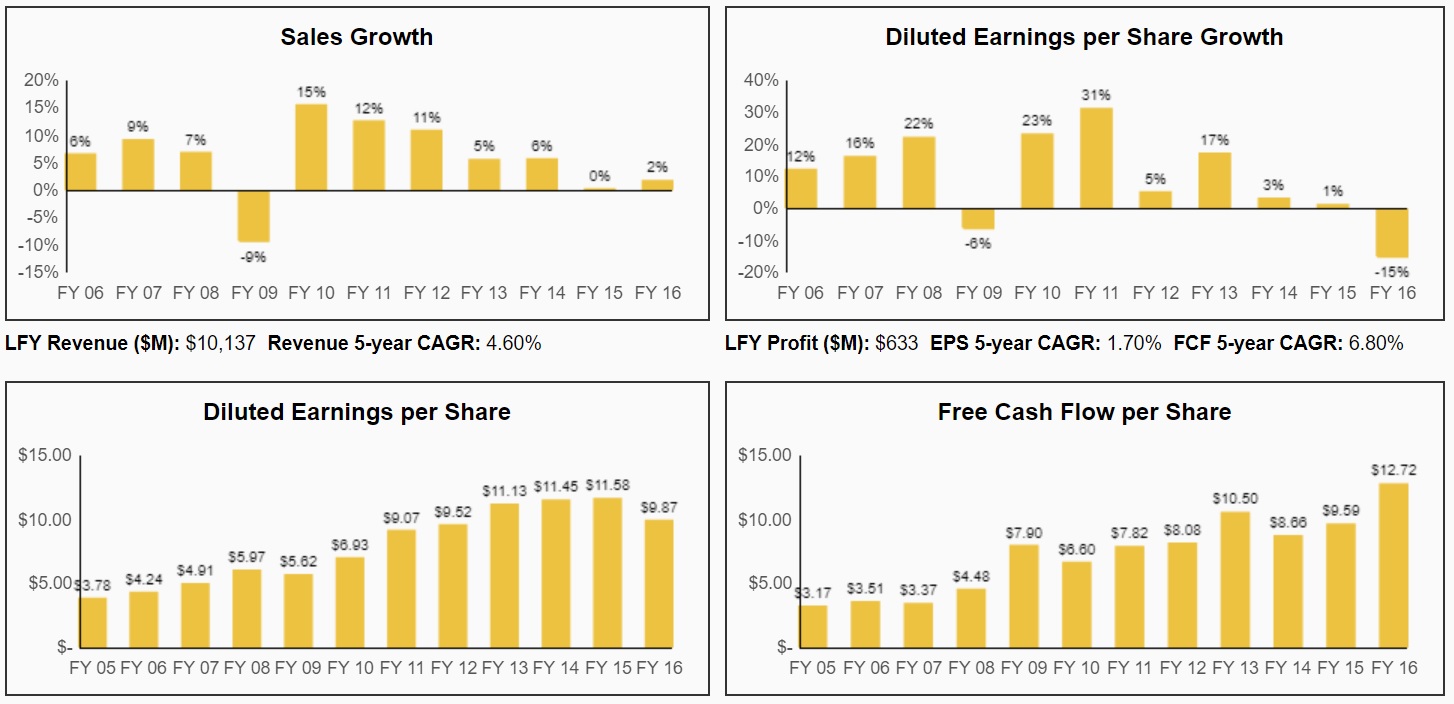

This helped the company enjoy consistent growth, fat margins, high returns on shareholder capital, and strong EPS and free cash flow (FCF) growth.

Source: Simply Safe Dividends

However, in recent years the ground has shifted under Grainger and the entire MRO industry. That’s because Amazon (AMZN) launched its Amazon Supply subsidiary, which directly targeted the $366 billion market in which Grainger operates in.

Amazon doubled down on its efforts to become a large scale business supplier in 2015 by rebranding Amazon Supply into Amazon Business, and the effect on Grainger’s sales and earnings has been negative.

That’s because, as Amazon founder and CEO Jeff Bezos likes to say, “your margin is our opportunity.”

Specifically, Amazon’s highly transparent online pricing model makes it much harder for Grainger to enjoy the kinds of markups it has in the past, which partially explains the company’s declining profitability of late.

Fortunately, Grainger has a long-term plan for competing with Amazon, one that it believes can return the company to profitable long-term growth.

Leave A Comment