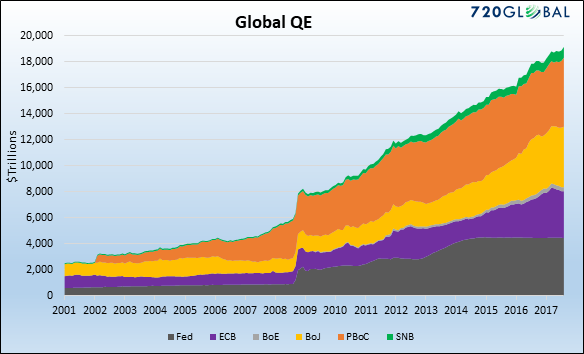

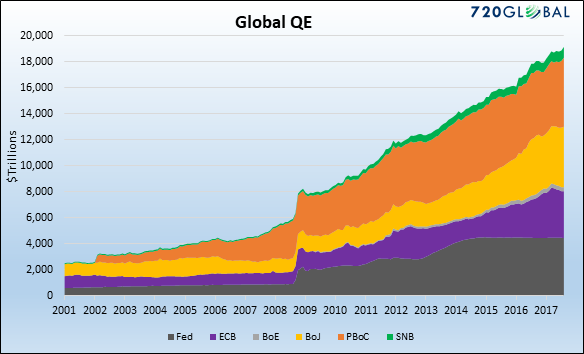

Over the last decade, the most influential central banks around the world have printed electronic currency credits to acquire $14 trillion in assets. The effect on stocks, bonds and real estate? Remarkable price gains as well as records galore.

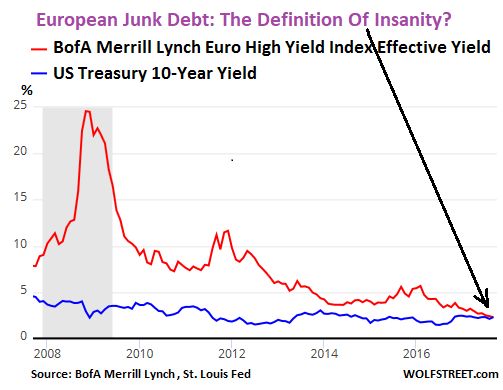

On the other hand, quantitative easing (QE) activity by the U.S. Federal Reserve, People’s Bank of China, European Central Bank and others has created a variety of implausible circumstances. The Swiss National Bank has become one of the largest shareholders in Apple (AAPL) with nearly 20 million shares on its books. The Bank of Japan owns three-quarters of the Japanese exchange-traded funds (ETFs) in existence. And European corporate junk bonds yield less than comparable risk-free U.S. Treasuries.

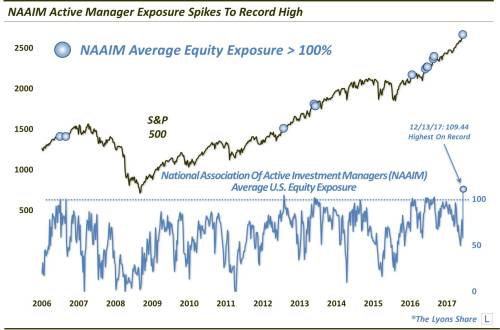

Perhaps ironically, few seem bothered by distortions and/or oddities. On the contrary. Active stock managers average 109% exposure to the asset class. That is not a misprint. The average exposure is greater than 100% such that active stock managers are “leveraged long.” The extreme reading is itself a rarity.

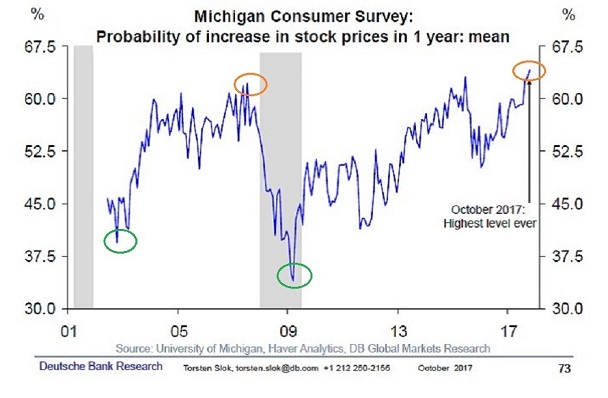

Retail investors are every bit as bullish as we move into 2018. According to the Michigan Consumer Survey, a record percentage of respondents expect stocks to be higher on a year-over-year basis.

Unfortunately, that may not be a good thing. More retain investors anticipate stock price increases over the next 12 months (10/2017) than they anticipated leading into the Great Recession.

In a similar vein, consider the stock market lows following the tech wreck (2000-2002) and the financial crisis (2008-2009). The best buying opportunities occurred when investor expectations for stock growth potential were at their lowest ebb, not when survey participants were extremely optimistic.

Another sign of complacency? The S&P 500 has rarely been as “overbought” as it is at the present moment. At no time in the current bull market have we seen weekly relative strength (RSI) levels as high as they are right now.

Leave A Comment