The market has finally started to bounce. Now it’s time to watch the nature of the bounce. So far, it looks like we’re going to see a short term rally that is part of a longer term down trend.

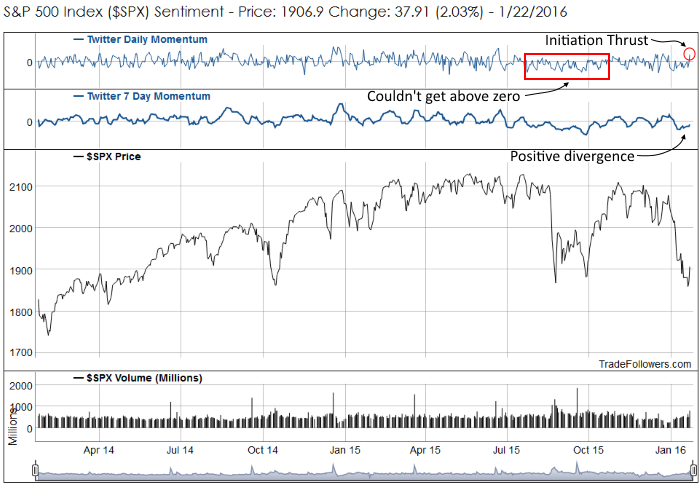

First, to the rally. On Friday, sentiment for the S&P 500 Index (SPX) generated from the Twitter stream printed a strong +21. Readings above +20 on the first day of a rally often mark initiation thrusts that have follow through for at least another couple of days. This is in contrast to the rallies out of the August and September lows where daily momentum couldn’t get much above zero. This indicates that traders were ready for a bounce.

Another sign that traders were anticipating a bounce comes from 7 day momentum. It painted a positive divergence with price all week as traders started tweeting about oversold conditions and covering their short positions. Over the next week the bulls want to see continued strong readings from daily momentum. A lack of strong readings will indicate that this is simply a short covering rally and long term buyers aren’t stepping up. You can see the daily updates to this chart here.

Now to the long term down trend. Our “Market Timing” indicator is a measure of breadth between the number of bullish and bearish stocks on the Twitter stream. The concept is simple; when there are more bullish stocks than bearish we’re in a long term up trend, and when there are more bearish stocks than bullish we’re in a long term down trend. On Tuesday, the breadth indicator dipped below zero for the first time since inception (late 2012). As a result, we made an official bear market call. Notice the strong rally on Friday didn’t reverse any damage done during the decline. In fact, the number of bearish stocks continued to rise and the number of bullish stocks continued to fall. You can see the updates to this chart daily here.

Support and resistance numbers for SPX gleaned from Twitter show a fairly bleak picture. There is no hope in trader’s tweets, but plenty of fear. This is another indication that we’re merely seeing a short covering rally, rather that new buyers with hope for substantially higher prices. Right now, 1925 on SPX is the most market participants are hoping for. Bulls want to see some tweets with price targets in the 1950 to 2000 range over the next week.

Leave A Comment