Less than a month after the WSJ reported first that Tesla was quietly asking suppliers for “cash back” on existing and future projects, describing the request as “essential to Tesla’s continued operation” and characterizing it as an investment in the car company, investors quickly sold off the stock sending it back under $300, amid growing fears of a liquidity crisis at the electric automaker.

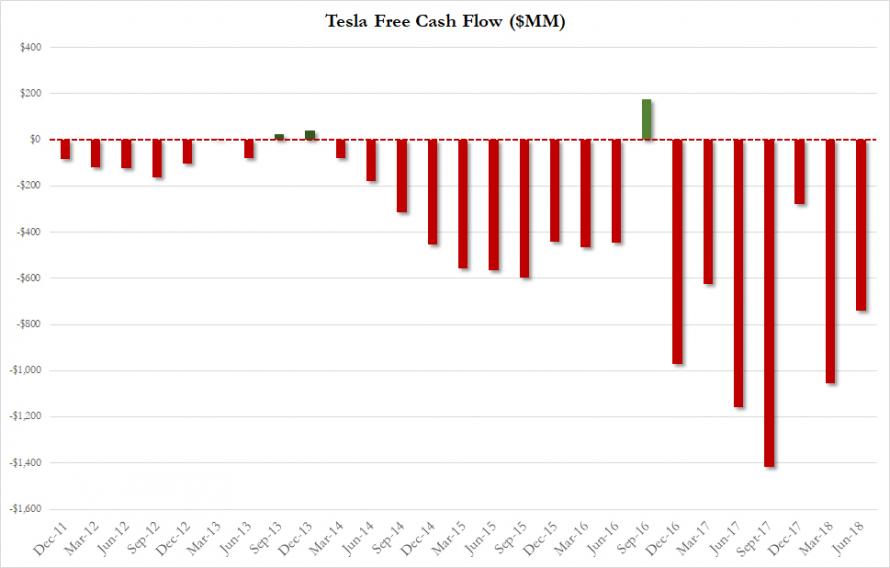

And while those fears were forgotten after the company’s “strong earnings” a few days later, and then forgotten even more after the tragicomedy involving the Saudi investment, Elon Musk’s take private tweet (with “funding secured” which we now know it wasn’t), the biggest problem facing Tesla’s ongoing profitability, viability, and existence, has been liquidity, or the lack thereof.

That problem has also just made a triumphal comeback when in a follow-up article, the WSJ reports that some of Tesla’s suppliers are increasingly concerned “about the auto maker’s financial strength after production of the Model 3 car drained some of its cash.”

Specifically, a recent survey sent privately by a well-regarded automotive supplier association to top executives and seen by the WS, found that 18 of 22 respondents believe that Tesla is now a financial risk to their companies.

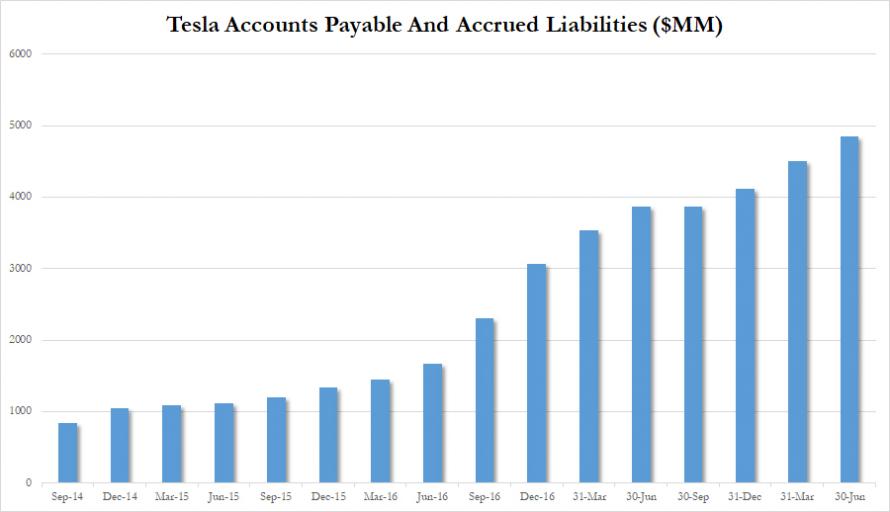

Meanwhile, confirming last month’s report that Tesla is increasingly relying on net working capital, and specifically accounts payable to window dress its liquidity, several suppliers said Tesla has tried to stretch out payments or asked for significant cash back. And in some cases, public records show, small suppliers over the past several months have claimed they failed to get paid for services supplied to Tesla.

In an interview with the WSJ on Friday, Elon Musk said that “we’re not behind because we can’t pay them. It is just because we’re arguing whether the parts are right”.

Still, while the universe of affected suppliers is small in the context of the entire Tesla supply chain, taken together, the survey, interviews, and documents show some suppliers are anxious about Tesla’s ability to pay them back.

Leave A Comment