Setting aside all other considerations and doubts about QQE, there was one factor that was supposed to be unassailable. That was the yen. QQE as a “money printing” operation was understood to act heavily on the exchange value of the Japanese currency so that it would drastically alter the competitive pricing of Japanese goods in Japan’s favor. From that point, the resurrection of Japan Inc. would be all but assured.

The Bank of Japan did manage that feat, as the yen dutifully obeyed perceptions even though bank reserves meant nothing tangible or useful (thus, NIRP). Japan Inc. did not follow.

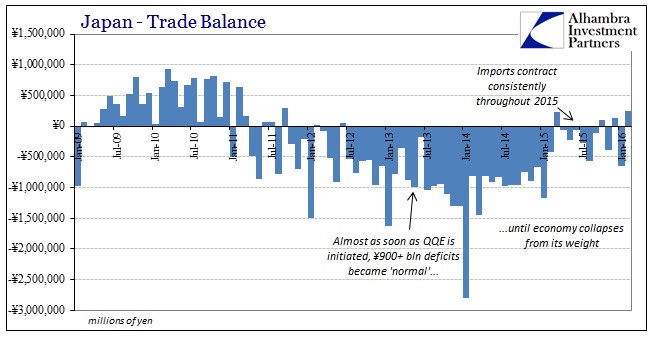

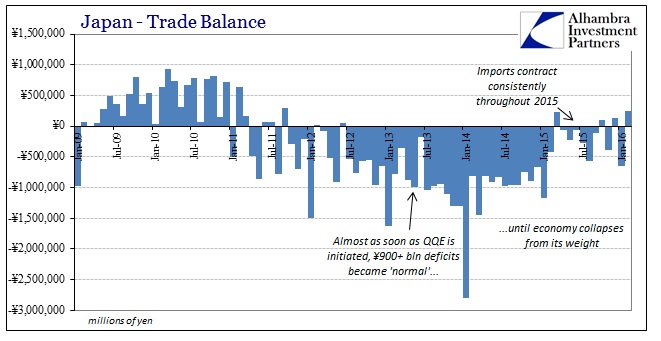

What did was blanket impoverishment as Japanese companies suddenly found themselves even more interested in offshoring productive capacity. Almost as soon as QQE was implemented, Japan’s once sterling trade balance turned to rot, often at or above a ¥1 trillion deficit in a single month. Those messy days seem relegated to historical oddity, though not for the reasons monetary theory predicted. Instead, both imports and exports are falling now, only imports collapsing much faster. The ongoing recession in Japan has finally cured in trade what the Bank of Japan offered in yen theory.

There is a lot to be determined from this one data series, and none of it good for Japan or the rest of the world. February was Japan’s largest trade surplus in more than four years because exports “only” declined 4% (after falling 13% in January) while imports dropped 14.2% (after falling 18% in both December and January). These are China-level import figures that are no longer being affected by the exchange value of the yen, meaning imports match all-too-well the decimation we find in Japanese household spending and income.

That is truly bad news for Asia including China since half of Japan’s imports are derived from its local continent. The Chinese Golden Week Lunar New Year skews the January and February comparisons, but cumulative totals for both months show that imports from China fell an enormous 13% 2015 to 2016. In Asia overall, that comparison was -13.8%, meaning that the rest of Asia received even less “demand” from Japan than China. With Chinese “demand” similarly absent, it is no wonder trade terms all across the Pacific are signaling disaster.

Leave A Comment