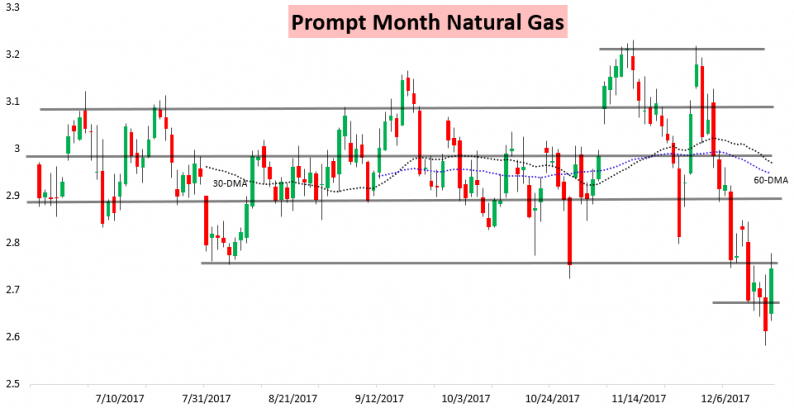

After two and a half weeks of intense selling, natural gas prices recovered today, rallying just over 5% on the day. This took prices right back to the resistance level around $2.75 that we had been closely watching.

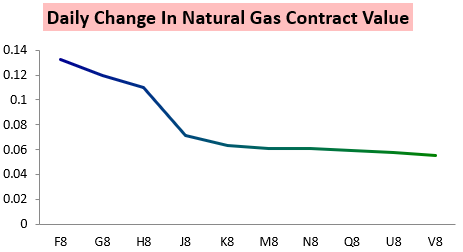

Looking out along the strip, the role of weather is quickly evident, with the front contracts rallying by far the most today. The Spring and Summer 2018 contracts (J-V8) pulled back into the settle more dramatically as well, accentuating the H/J signature with the front of the strip more supported.

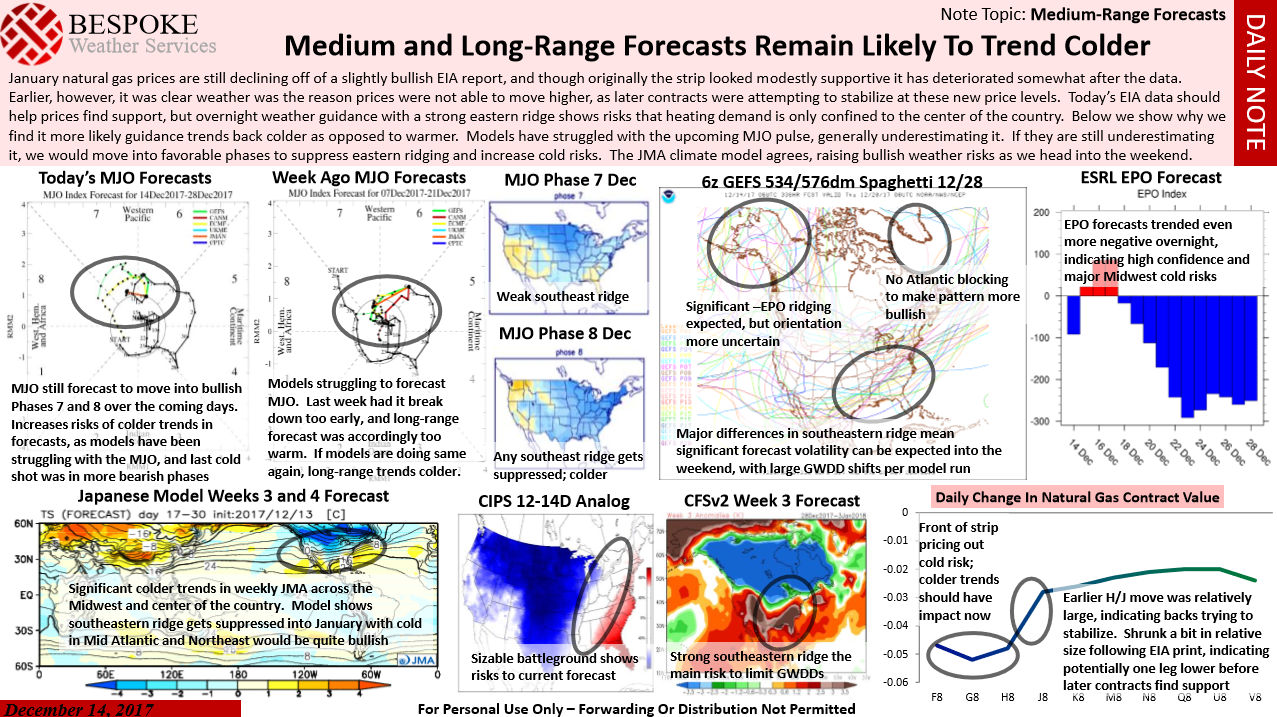

This is a rather classic indicator that weather was behind the recovery in prices today, and forecasts did trend significantly colder over the weekend. In our Note of the Day for clients today, we analyzed how short-term forecasts had trended decently warmer but medium and long-range forecasts were easily colder, spiking prices.

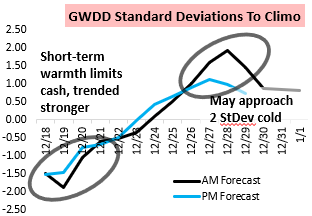

We compared our AM GWDD forecast to that of our PM Friday forecast, where though GWDDs approach 2 standard deviations below average tomorrow they then quickly get near 2 standard deviations above average in the final week of December. These colder trends did not strike clients by surprise; our Note of the Day last Thursday did not mince words in warning that model guidance was currently too warm and overdoing ridging in the East.

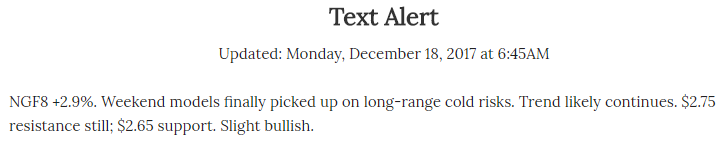

Sure enough over the weekend those exact colder trends arrived, and they helped prices recover significantly. We were on top of them, advising clients to watch for $2.75 resistance to be tested in our Early Morning Text Message Alert, which emphasized that our natural gas sentiment was slightly bullish. Prices briefly broke through that resistance level but declined into the settle to close right at it.

We had also been watching the January/February F/G spread recently in an attempt to determine how seriously the natural gas market was taking short-term cold. If cold looks more significant, it would elevate cold prices into the end of December and increase demand, raising the prompt month January natural gas contract more than the February contract. We saw the spread flat on Friday despite intense selling, indicating the market was not declining on weather expectations. Today the spread narrowed dramatically, which would be one indication of weather’s role in the recovery.

Leave A Comment