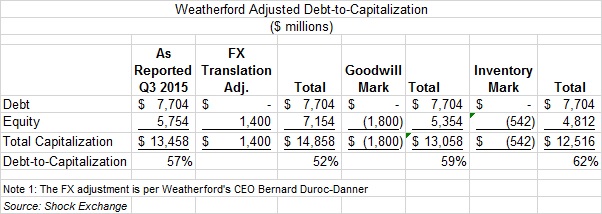

I have a list of major issues with Weatherford International WFT. I believe the company’s goodwill and inventory could be overstated by over $2 billion. Asset write-downs of that size could cause Weatherford to fall out of compliance with its debt covenants. On its Q3 earnings call, management divulged that its debt-to-capitalization would be positively impacted by $1.4 billion in add-backs for foreign exchange translation adjustments. This would bring its debt-to-capitalization ratio to about 52% at Q3 2015.

It begs the following questions, “How did Weatherford accumulate $1.4 billion in FX adjustments and how will it impact its ability to pay claims or debt obligations going forward?”

The Situation

With $7.7 billion in debt at junk levels, Weatherford needs to preserve as much capital as possible. That’s problematic as the company’s Q3 revenue and EBITDA were down Q/Q by 6% and 2%, respectively. Over 90% of the company’s EBITDA comes from outside North America, so FX adjustments have an outsized impact on the bottom line.

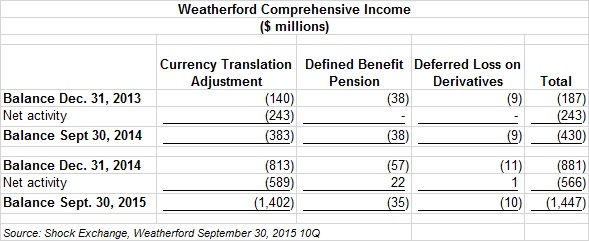

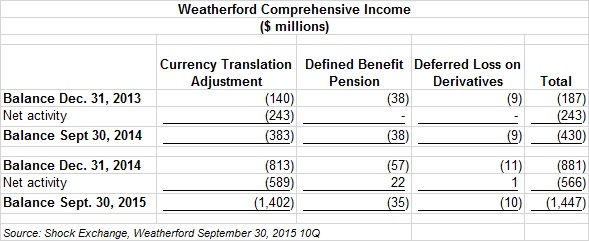

The currency translation adjustment is part of total comprehensive income. The adjustment was as little as $140 million at December 31, 2013 and grew to $1.4 billion at September 30, 2015. Net activity from year-end 2014 to Q3 2015 was -$589 million, which implies that declining currencies against the dollar have taken a toll on Weatherford’s bottom line.

FX Impact Could Amplify Liquidity Strain

The following chart highlights Weatherford’s cash balance by subsidiary.

The lion’s share of cash is held at “other subs” outside Ireland, Bermuda or Delaware. This cash is likely housed internationally. Given the impacts of FX, that too could be problematic. For instance, I had the following conversation on Twitter (NYSE:TWTR) concerning Weatherford in October:

When $slb sneezes, $wft catches the Spanish flu. Angola represents 25% of $wft balance cash. @ShockExchange @BrattleStCap

— SoL (@xuexishenghuo) conversation

Leave A Comment