More bad news from Japan and China.

Industrial Production in China was once again revised lower – to 5.6% Growth from 5.7% in September while Fixed Asset Investments were only up 10.2%, slowing from 10.3% and, while these seem like good numbers, they are the slowest annual pace in over 20 years! The Chinese Government’s official PMI figure came in at 49.8 in October – still contracting while the private Markit Survey measured worse, at 48.2.

China’s Shanshui Cement will be the next major corporation to default on their bonds, heading into defaut on $314M next Thursday. Shao Jiamin, who heads HFT Investment Management (China’s top bond fund) predicts “a substantial correction in riskier debt as the restart of initial public offerings drives money back into shares.” Any collapse could damp Chinese investors’ enthusiasm for fixed-income, just as President Xi Jinping seeks to create a stable fundraising platform for small businesses and maintain access to financing for state-led infrastructure projects.

Just to the east of China, Japanese Business Confidence is down for the 3rd consecutive month to a 2.5-year low at 3, down more than 50% from 7 in September reflecting fears that a China-led slowdown in overseas demand may have pushed the economy into recession. The poor poll results will be followed by government data out on Monday, which is expected to show the economy slipped back into recession through September due to a drop in capital spending in the face of weak foreign and domestic demand.

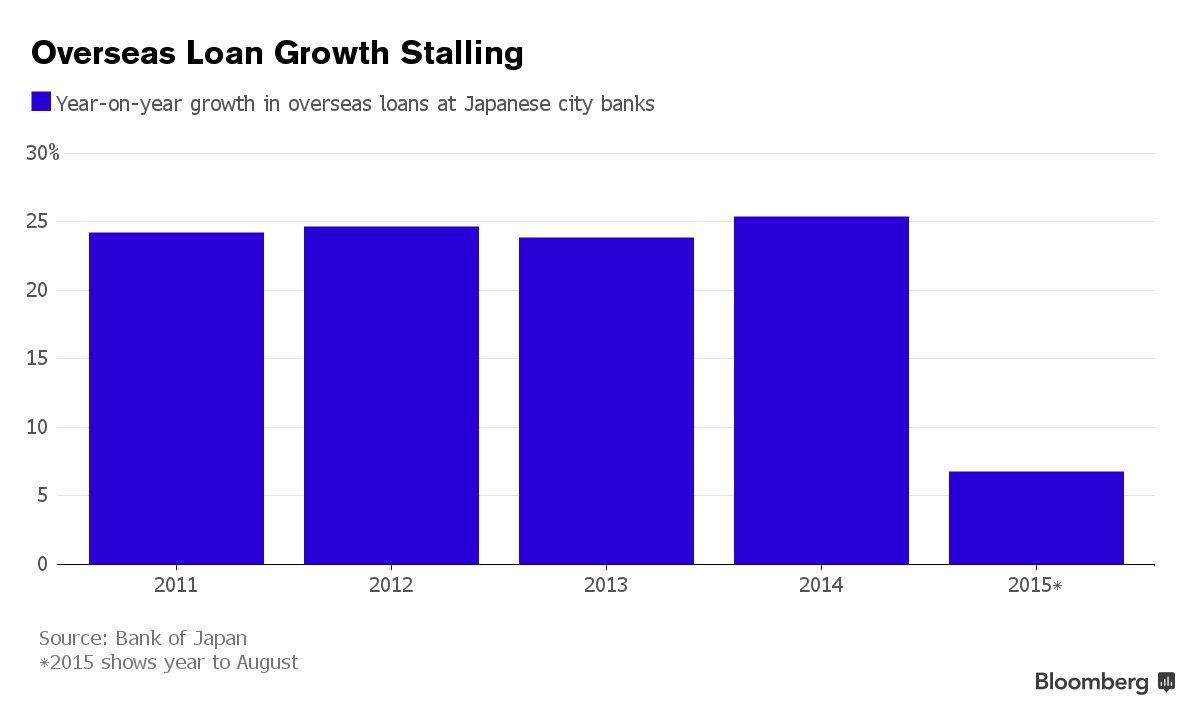

Meanwhile, Japan’s three biggest lenders will probably report a drop in second-quarter profit after Asia’s economic slowdown weakened overseas loan growth and global financial-market volatility crimped fee businesses. Combined net income at Mitsubishi UFJ Financial Group Inc., Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. fell 24 percent from a year earlier to 597 billion yen ($4.8 billion) in the three months ended Sept. 30, according to calculations based on the average of five analyst estimates compiled by Bloomberg.

Leave A Comment