Here’s an indicator that has successfully predicted major market corrections:

It’s the so-called “Smart Money Indicator” which tracks the number of bearish put options vs the number of call options with the expectation that options traders have some clue as to what the market is doing – as they tend to be more serious investors (the ones that survive, that is). Of course, it also gave a false warning , like it did in 2003 and 2012 and last fall, when we first went over the 2:1 line but now it’s just getting silly and open put contracts now exceed call contracts by 3:1 for the first time ever.

Once again, I’m not saying we should join them and get all bearish – I wish it were that simple. Unfortunately Fundamentals have been thrown out the window in this Global QE environment and all I can do is warn you that it’s not a good time to be betting the market goes higher and the smart move is to have a ready supply of CASH!!! on the sidelines – just in case the market completely collapses.

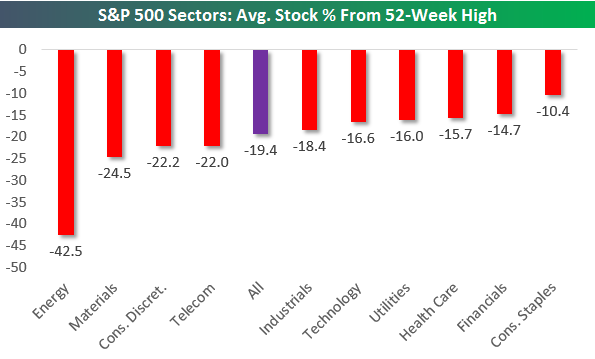

We’re well-hedged and very cashy in our Member Portfolios and thank goodness for that because, according to Bespoke, the average stock in the S&P 500 is 20% BELOW it’s 52-week high. That would be called a correction but, as I’ve noted before, there are 8-10 stocks that have accounted for all of the S&Ps positives this year. Other than those few headline stocks, EVERY SINGLE SECTOR is off 10% or more this year:

The smart money is in CASH!!! We are in CASH!!! Cash is good, it’s not some failure on your part if you don’t see anything good to invest in and you sit on the sidelines. This is something I have to work very hard to teach our new Members – that sometimes the only winning move is not to play. Yes, while you are in cash you will see things you wanted to buy going up and you will regret it. That’s because human nature is to focus on “the one that got away” rather than the stocks you actually would have bought that tanked. Think of every baseball game you ever played – do you ever talk about the strikeouts?

Leave A Comment