Last week, I started the weekly reading list by stating:

“This week has certainly been interesting with the Dow Jones Industrial Average having the worst start to a year…well…ever.”

This week was not much difference as the markets continued their slide into the “worst-start-of-the-year-everer.”

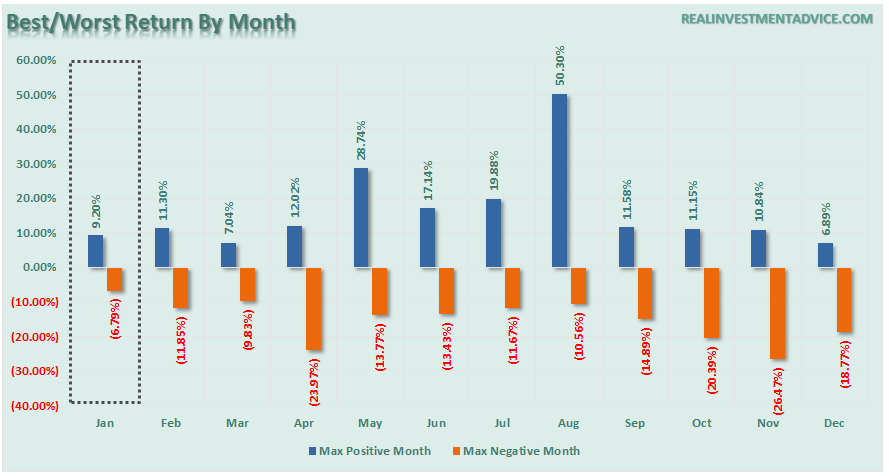

However, with the markets roughly down 7% since the beginning of this year, it certainly has seemed painful as investors have been slammed from all angles. However, as I addressed earlier this year with respect to January statistics, this is well within historical norms. To wit:

“Furthermore, while January’s maximum positive return was just 9.2%, the maximum drawdown for the month was the lowest for all months at -6.79%.”

“However, given the length of the current bull market run from 2009 to present, the risks are mounting that January will likely have consecutive negative performance years which would confirm the ongoing market topping process I discussed previously. Such an outcome would suggest a more conservative approach to investment allocations.”

With the markets now extremely oversold on a short-term basis, it is quite likely that a bounce will occur in the days ahead. Such a bounce will likely be met by sellers wanting to reduce risk of a more substantial correction. But will they be right?

This weekend’s reading list is a collection of articles on the current state of the market. Is the bull still alive or is it being hunted by the bear?

1) Death Throes Of A Bull Market by Anthony Mirhaydari via Fiscal Times

“Fed Chair Janet Yellen will be forced to either acknowledge labor market tightening as reason to continue with the four-hike schedule for 2016 or risk her credibility, belittle job market stability and sound a warning about the risks of lower oil prices and cheap gasoline (sacrilege to regular Americans) by slowing the hiking pace after a single 0.25 percent increase last month.

If she gets it wrong, things could get ugly fast.

The Russell 2000 has dropped all the way back to levels last seen in October 2013 as it has dropped below its 200-week moving average for the first time since 2011.”

Leave A Comment