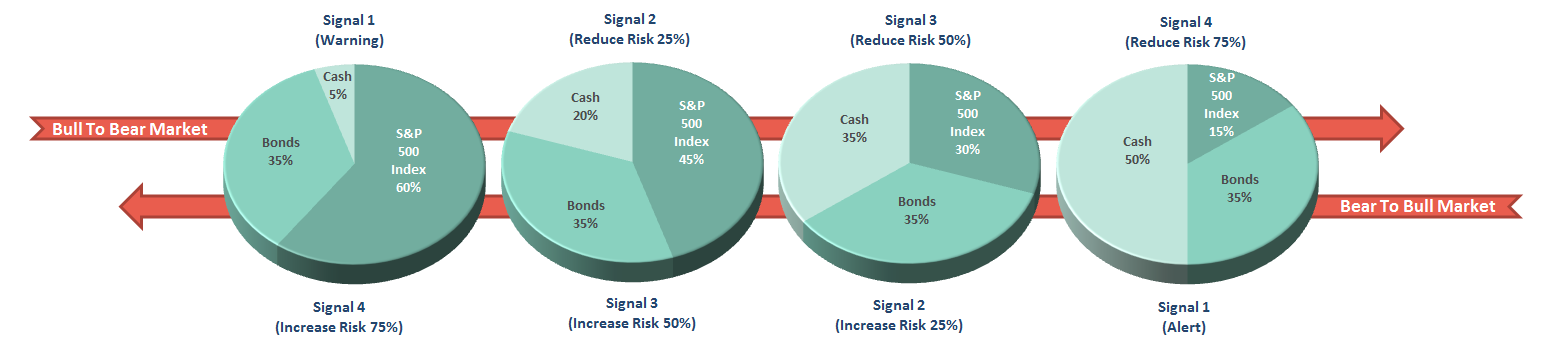

In my money management process, portfolio “risk” is “ratcheted” up and down based on a series of signals which tend to indicate when market dynamics are either more, or less, favorable for having capital exposed to the market. This model is published each week in the Real Investment Report as shown below:

As you will notice, portfolios NEVER reach 100% cash levels. The reason is purely psychological. Once individuals go to 100% cash, it is extremely hard to re-enter back into the markets. I learned this lesson in February 2009 when I wrote the article “8-Reasons For A Bull Market” which stated:

“Any weakness next week will most likely warrant a push down to 800 for first support and then the November lows of 750. We believe that these lows will hold although we are aware that if the market doesn’t get ‘it’ together soon further weakness could show itself.

We are cautious here and still holding on to a lot of cash waiting for some signal that the market is making a turn for the short term to the better. March, April, and May tend to be fairly strong months for the market and any ‘real’ assistance next week for homeowners could push the markets higher. A move above 900 will be a signal for a move higher in the markets.“

Of course, the market bottomed on March 9th at 666 and never looked back as over $33 trillion in various bailouts, workouts, subsidies, and QE followed.

However, when the markets bounced above 900, suggesting it was time to re-enter the market, I faced extremely tough resistance from clients. I learned that by maintaining a small slug of exposure, which can be completely hedged, it becomes far easier to add to an existing position as improvement can already be seen.

So, why do I bring this up?

Because the market has now tripped the first signal as shown above, and below, sending a warning that further weakness could ensue. With the first signal registered, combined with a break of the 50-dma, it puts us on “a signal-1 alert.”

Leave A Comment