USD/CAD

Without a doubt, the easiest trend that I see in the moment to follow is the USD/CAD bullish trend. After all, the oil markets continue to struggle, and with this I believe it’s only a matter of time before the buyers step in every time we pullback. Oil seems to have no bottom in sight, and with that I think this pair goes higher given enough time. Pullbacks offer value that I think you can take advantage of again and again.

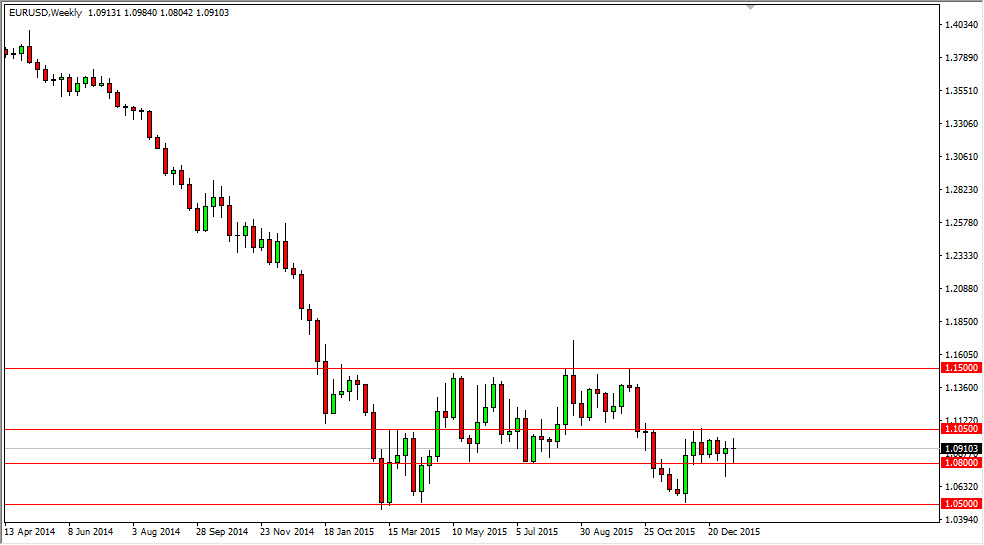

EUR/USD

The EUR/USD pair pulled back during the course of the week, but found enough support at the 1.08 level to turn things around and form a bit of a hammer. Because of this, I think it’s only a matter of time before the buyers get involved, but it’s not really free and clear to go higher until we break above the 1.1050 level. Once we get above there, it should become a very bullish market.

AUD/USD

The AUD/USD pair fell during the course of the week, and it now appears that the market is going to continue to go much lower. I believe at this point in time the next target is the 0.65 handle, and it is only a matter of time before we reach that level. However, we could get a few short-term rallies, but I look at those as nice selling opportunities.

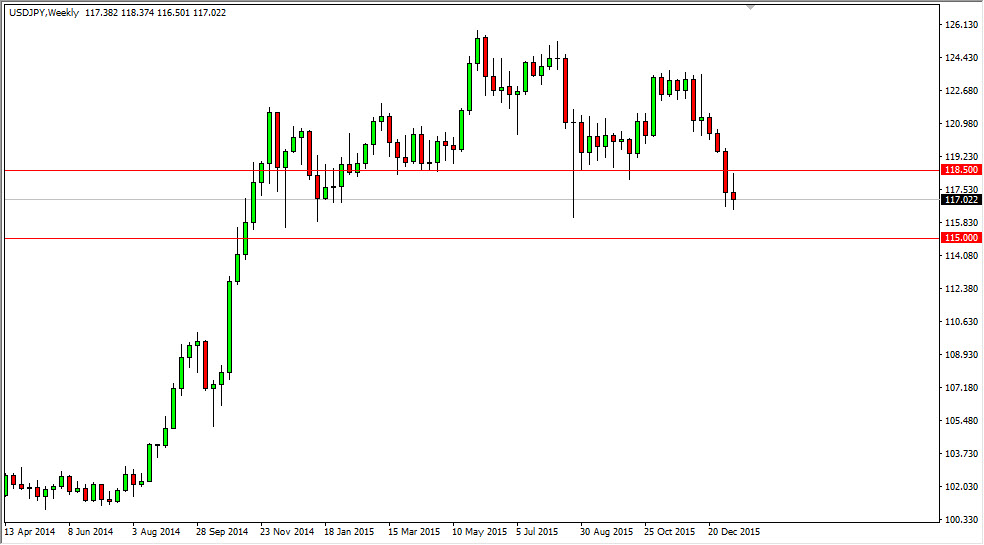

USD/JPY

The USD/JPY pair initially tried to rally during the course of the week but found enough trouble at the 118.50 level to turn things back around and form a shooting star. The shooting star suggests that the market is going to break down from here, and that it could very well try to reach the 115 handle. Regardless, I am sellers of short-term rallies as I believe this market will continue to show quite a bit of softness until we can reach above the 118.50 handle on a daily close.

Leave A Comment