Weekly Market Outlook – March 7th, 2016

Friday’s finish was a lackluster one, possibly hinting that this leg of the rally has finally run out of gas and the bulls need a breather. Of course, after what was nearly a 10% runup from the mid-February low, a break for the bulls is neither surprising nor especially troubling just yet. The crux of the matter is when, where, and if any rest period for the rally comes to a close and the bullishness is rekindled.

We’ll look at the line in the sand in a moment, right after a quick run-down of last week’s and this week’s economic data.

Economic Data

Last week’s economic dance card was pretty full, but only a couple of items were of any real interest… the ISM data, and February’s job report.

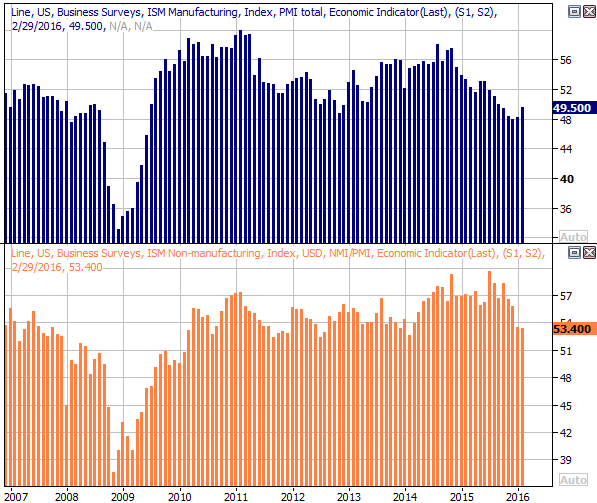

As for the ISM numbers, both were a little better than expected.The ISM manufacturing index ticked a little higher from 48.2 to 49.5 (versus an expectation of 49.0). But, still under the 50 threshold, it indicates a contraction. It’s the second month in a row we’ve seen a slightly higher reading, however, so perhaps where at least pointed in the right direction.Another bad month or two from this data could become a problem.

The ISM services index, on the other hand – although falling for a while now – remains above the key 50 level, rolling in at 53.4 for last month.Even so, the readings for the last couple of months have been on the low end of the long-term range, and we could use a rebound soon.

ISM Index Chart

Source: Thomson Reuters

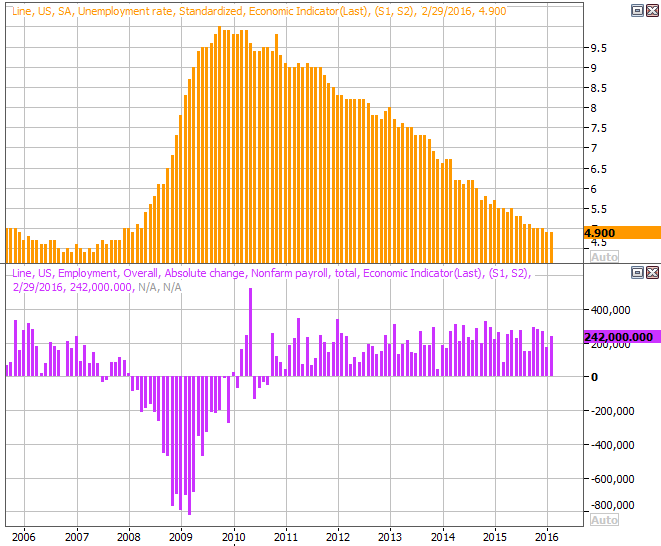

The U.S. economy added 242,000 new jobs last month. That was better than the expected 180,000, and more or less in line with the recent average. It wasn’t enough, however, to push the unemployment rate any lower than its current reading of 4.9%. That’s still nearing an absolute low possibility though.

Payroll Growth & Unemployment Chart

Source: Thomson Reuters

While the primary unemployment figures paint a modestly bullish picture, they don’t tell the whole story… and the rest of the story is at least a little more encouraging.

Leave A Comment