Weekly Market Outlook

What started out as only a modest possibility last week didn’t take long to turn into the worst-case scenario. The S&P 500 (SPX) (SPY) gave up 3.6% of its value last week… the biggest weekly drop since the one that did the core of damage in mid-August.

Uncertainty regarding the health of the economy after a few-too-many disappointing retail earnings reports was largely to blame for the weekly setback, though uncertainty surrounding the near-term future of interest rates took a toll as well.

Of course, it may also be possible that stocks were overbought and simply ready for some profit-taking.

We’ll consider all of it in a moment, after a quick run-down of last week’s and this week’s major economic news.

Economic Data

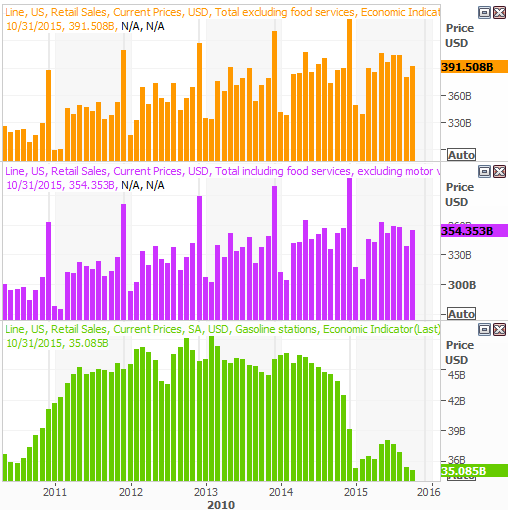

The only item of real interest last week, in terms of economic news, was October’s retail sales data. It was up, but not as much as expected. Retail spending grew 0.1% overall and 0.2% excluding cars, but analysts had forecasted growth of 0.5% and 0.3%, respectively. Still, consumerism is making forward progress.

As the chart below shows, on a year-over-year basis, overall retail spending is still growing, which is made doubly impressive by the fact that it’s offset significant decreases in gasoline sales.

Retail Sales Chart

Source: Thomas Reuters

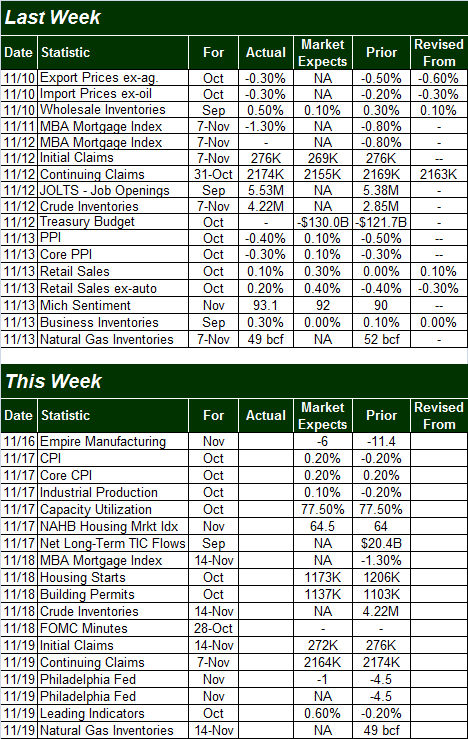

We also heard October’s producer price inflation rate last week, and if it’s an omen of what to expect when we get consumer inflation rates this week, then inflation may be the least of our problems. Deflation could be a bigger concern now, giving the Federal Reserve time and reason to delay the rate hike rumored to be in the cards next month.

Economic Calendar

Source: Briefing.com

As was noted above, we’ll be hearing October’s consumer inflation news this week… on Tuesday, to be precise. Analysts are calling for a 0.1% increase on a core as well as a non-core basis, but it might be wise to prepare for an even weaker report.

Leave A Comment