The economic calendar is normal, with a holiday-shortened week and some ongoing political worries. Competing with the Washington Circus will be Q417 corporate earnings reports. The former topics will have greater news interest, but investors should be digging into the earnings reports. The earnings story is always a tasty stew – expectations, results, differing measures, revenues, and future expectations. The tasters are free to report their impressions. Sound benchmarks are elusive. This season has an extra ingredient – the tax cut effects. I expect the punditry to be looking ahead, and asking:

How should investors interpret Q4 earnings updates?

Last Week Recap

In the last edition of WTWA I expected a focus on inflation effects. While that generated some attention and headlines, the modest PPI and CPI reports stilled any imminent worries. Many sell-side firms and columnists continued to describe their worries for 2018, our theme of the last two weeks.

The Story in One Chart

I always start my personal review of the week by looking at a great chart. I especially like the Doug Short design with Jill Mislinski updates and commentary. You can see many important features in a single look. She notes the new records along with other indicators. The entire post is well worth reading for the collection of charts and analytical observations.

The trading range for the week was about 2%, below last week’s 2.6%, but higher than in recent months.

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too.

The economic news was good. Before the inflation numbers I published a guide to assist interpretation. Many seemed to find it useful, and one of my plans for the new year is to more analysis of economic indicators.

The Good

Inventories increased to 0.8% on wholesale goods and 0.4% for businesses. Both numbers were higher than expectations and big increases over the prior month. Inventories are a favorite target for pundits. Bulls claim that businesses are stocking up for anticipated demand. Bears say that they are stuck with unwanted goods. How can one tell? New Deal Democrat, in his fine weekly compilation of high-frequency indicators, suggests the following:

November data included business inventories, which increased slightly at all levels, but were outpaced by strong sales, meaning that the inventory to sales ratio declined to a 2.5 year low.

The Bad

The Ugly

The Hawaiian false alarm. We now know that it was caused, at least partially, by one person “pushing the wrong button.” There is a sophisticated detection system, reports CNN.

The detection triggers an instant Strategic Command, or STRATCOM, assessment process. The assessment looks at where the launch is, the potential type of missile, trajectory, apogee, distance and potential targets in the path of the missile.

Top military commanders join a conference call, with the top priority being to decide whether the missile is a threat to the US or its allies.

If the missile is a threat, the president is brought in and response decisions are made. NORAD (the North American Aerospace Defense Command), STRATCOM, intelligence agencies and the National Security Council are involved in the decision-making.

The many affected people did not get a correction for 38 minutes as they gathered, wept, and prayed with family and friends. Like me, some were probably reminded of this iconic image of Slim Pickens:

Noteworthy

Are you smarter than a Dolphin? You will enjoy the fascinating story of Mississippi resident (Institute of Marine Mammal Studies), Kelly the Dolphin, who has taught other dolphins and “trained the humans.”

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that. Second best is planning what to look for and how to react.

The Calendar

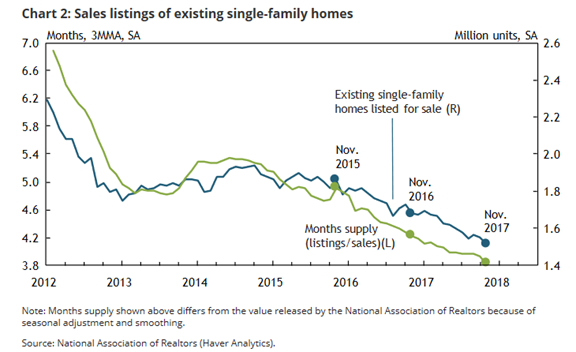

We have a normal economic calendar, but a holiday-shortened week. The housing data is most important, and Michigan sentiment is also of interest. FedSpeak and the Beige Book will provide an excuse for commentary on a topic where every pundit, news anchor, and blogger has an opinion: The Fed. (See Fed authority Tim Duy if this is your personal concern). The approaching expiration of the debt limit extension is important.

Leave A Comment