There was something of a change in tone last week. There is more recognition of improving conditions. With a tailwind from improving earnings, more will be wondering:

What if you have missed the rally?

Last Week Recap

Last week began with stories about revised targets for the market and ended with Fed speculation. The market took the international stories and news about President Trump in stride.

The Story in One Chart

I always start my personal review of the week by looking at a chart of market price moves. The Wednesday pre-market release of Chair Yellen’s Congressional testimony was the most notable feature. The market gained 1.4%, reaching a new all-time high.

Personal Note

I am on vacation starting Friday and through the next week. This means that I will probably miss two installments of WTWA. Since readers requested and appreciate the “limited editions” we have produced when I have been away, we’ll do that again. We will include indicator updates, a few observations on news and worries, and perhaps some “timeless” advice that has special relevance right now.

Since I cannot ever get completely away, I’ll be in touch with events and my office. Is something important is happening, I’ll get involved. The last time I went to Toronto my vacation was spoiled by the debt limit crisis. I hope to avoid a repeat of that.

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

The economic news last week was mixed, but tilting positive.

The Good

Fed news satisfied the markets. That is one test, but it does not change the favorite sport of Fed-bashing.

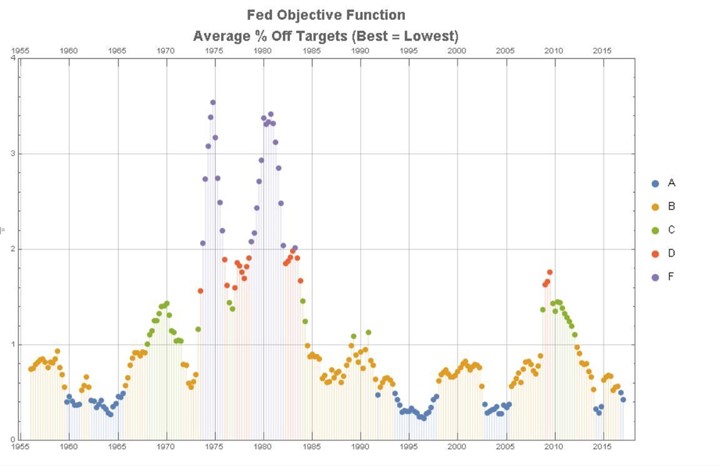

- Jason Cawley (who brings strong analytical skill and experience to the problem) takes a refreshing perspective in his article, Grading the Fed. He analyzes the Fed in terms of their own stated objectives – not those of critics. Those interested – and you should be – must read the entire article and the grades for each objective. Here is an example chart.

He concludes as follows:

I submit that most of those criticizing recent Fed policy from various points of view seldom apply their proposals with the rigor shown above, or explain why they believe their alternative proposed measures of Fed policy success would be superior to its published methods, or where and when their different proposed measures would grade recent Fed performance poorly. I invite them to do so in the comments section below, or in their own articles.

- The NY Fed has a great explanation of how the balance sheet is adjusted. If you understand this, it provides an antidote to some of the daily misinformation. (Economicintersect.com highlighted this story, as it does with so many useful articles). There is a great chart sequence (clear, but too long to reproduce here) that shows the effect of Fed actions. If everyone spouting an opinion had to pass a short quiz on the basics, the world would be a quieter place!

Leave A Comment