(Photo Credit: Quintin Doroquez)

The numbers are in, and Apple iPhone sales are showing no signs of slowing despite recent worries regarding market saturation. Three days after the official launch, Apple sold more than 13 million iPhone 6s and iPhone 6s Plus units this weekend, a company record. This is up from the 10 million units that were sold in the first weekend of the iPhone 6 and iPhone 6 Plus launch.

The initial success of this new generation of iPhones can be attributed in part to new features that have really resonated with customers. CEO Tim Cook said in this morning’s release that “customers’ feedback is incredible and they are loving 3D Touch and Live Photos, and we can’t wait to bring iPhone 6s and iPhone 6s Plus to customers in even more countries on October 9.” Expansion into 40 additional countries next month, including Italy, Mexico and Spain, is expected to give these latest iPhone models an advantage that past releases haven’t had.

Of course, the biggest boon for Apple has been its advancement into China, just receiving approval from Chinese regulators earlier this year to sell iPhones. China has without a doubt been Apple’s most important territory in 2015, and sales there are closely tracked by investors and analysts alike. During its fiscal Q2 2015 report back in April, Apple reported that iPhone sales in China outpaced the U.S. for the first time ever. In the latest quarterly report released in July, YoY growth in Greater China was up 112%. The latest iPhone models were made available in China on launch day, something that wasn’t true of the iPhone 6/iPhone 6 Plus release.

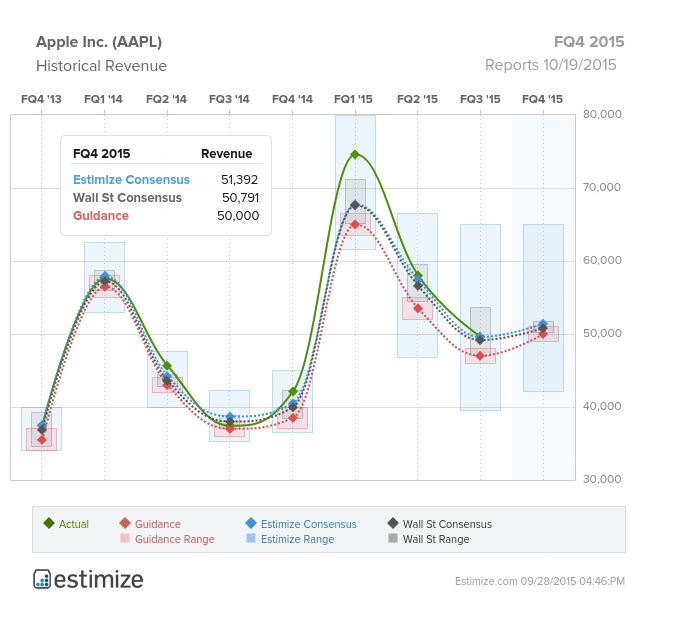

First weekend demand is an important indicator and should say some good things about the upcoming earnings season. Apple reports fiscal Q4 2015 on Oct 19, and sales completed by September 26 will be included in that result. At present, Estimize has 217 estimates for the tech giant, which is on target to beat the record of 600+ contributors last quarter, meanwhile Wall Street will max out at around 40 estimates. This matters due to theory behind the law of larger numbers, ie: the crowd is wiser. Last quarter, our consensus of $1.86 came in much closer to the actual of $1.85 than Wall Street’s prediction of $1.80. The EPS consensus for Q4 stands at $1.90, higher than Wall Street’s $1.87 and indicating growth of 34% from the year-ago period. The Estimize community is expecting revenues of $51.4B as compared to the Street’s $50.8B and guidance of $50.0B. Upward revisions are expected to occur over the coming weeks as a result of today’s announcement.

Leave A Comment