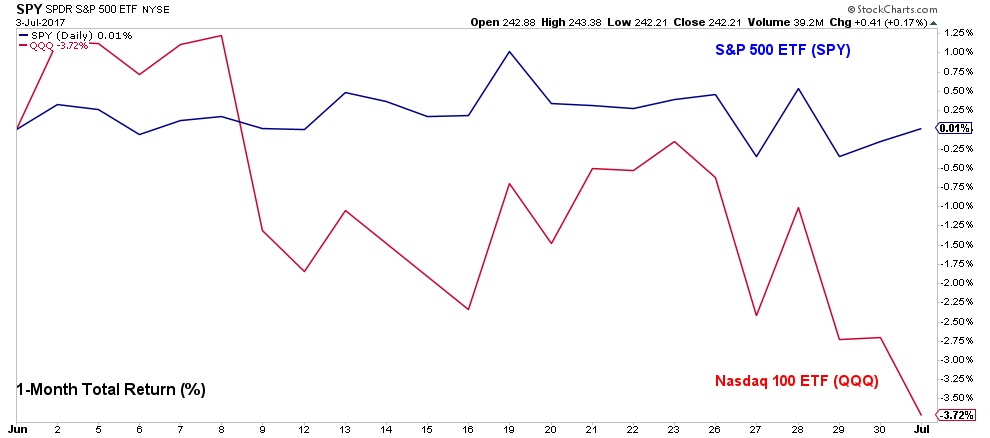

Over the past month, the Nasdaq 100 ETF (QQQ) is down 3.7% while the S&P 500 (SPY) is up 0.01%.

Is this a good, a bad thing, or a “nothing burger” for markets?

Let’s take a look at the data to find out.

First, it’s important to note that such a wide divergence in performance is relatively rare. Out of 4,573 trading days since the inception of the Nasdaq 100 ETF, there were only 73 instances where QQQ was down more than 3% over the prior month while SPY was positive.

In those 73, instances, the forward S&P 500 returns have been below average in all time periods from 10 days through 12 months. The percentage of positive returns is also below average.

On average, it seems that Nasdaq 100 weakness in the face of a resilient S&P 500 tends to be a negative factor for the market ahead. When the Nasdaq 100 lags, the S&P 500 tends to follow that weakness, particularly over the subsequent month.

Will that be the case today? I don’t know. These are only averages; there have been many times where the Nasdaq 100 has been weak and nothing bad occurred.

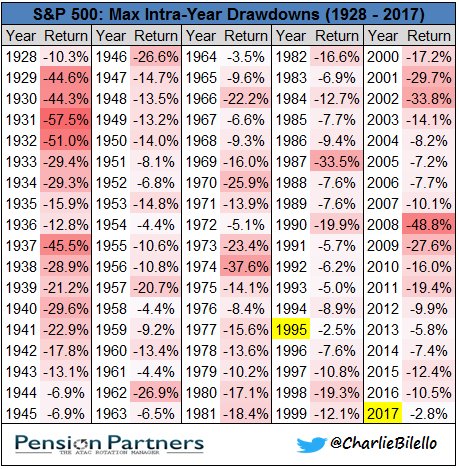

But with the S&P 500 up 8 straight months and 15 out of the past 16 entering July, it is certainly something to consider.

With the Nasdaq 100 leading to the downside and Technology representing the largest sector in the S&P 500 (at 22%), a larger drawdown (than the near-record low of 2.8%) in the coming months would not be surprising. It would be more surprising if such a drawdown did not occur.

Leave A Comment