Image Source: Pexels

Image Source: Pexels

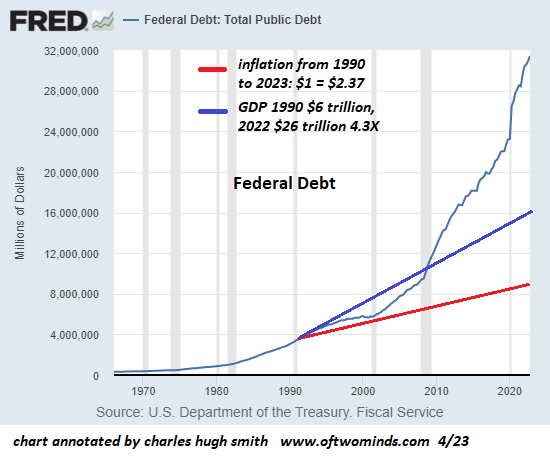

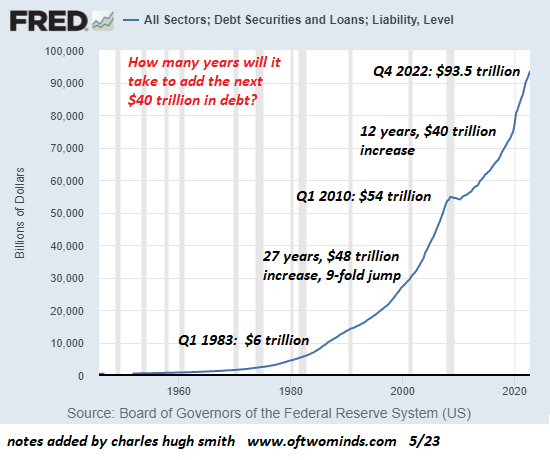

One of the favorite parlor games of financial analysts and seers is to make predictions about what will happen in the coming year based on past analogs such as the presidential election cycle, bond yield inversions, the Federal Reserve cutting interest rates, and so on.Part of the parlor game is to dig up obscure metrics and parse the percentage of the time that the analog worked in the past, a classic confusion of correlation and causation: just because financial condition X occurred when a team from the old AFL wins the Super Bowl doesn’t mean the Super Bowl caused financial condition X to occur.In other words, all analogs are worthless unless the claim is that the current causal conditions are so close to previous causal conditions that the current conditions will generate the same results. This test eliminates correlations that have weak causal links (for example, the presidential election cycle) and focuses our attention on claims of direct causation: for example, the Fed cutting rates will boost stocks because lowering interest rates will crank up sales and profits, which will push corporate equities’ valuations higher.I would argue that current conditions are so extreme that none of the usual analogs will play out as predicted. Consider the state of the banking sector and the Federal Reserve’s unprecedented transfer of tens of billions of dollars to banks keeping reserves at the Fed. A policy of subsidizing banks at such a scale is without precedent.Next, consider federal debt, which is expanding at rates that are unprecedented in peacetime. Where’s the analog for adding trillions in debt as inflation demands elevated bond yields cannot go back down to near-zero? There is none. How about total debt, public and private? Is there any precedent for geometrically increasing debt as yields rise and remain above the rate of inflation? If so, when?

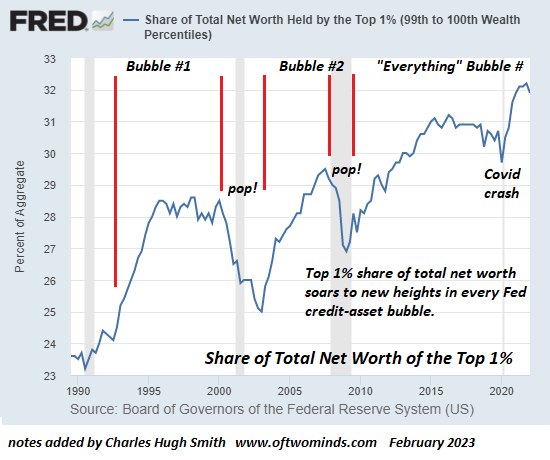

How about total debt, public and private? Is there any precedent for geometrically increasing debt as yields rise and remain above the rate of inflation? If so, when? How about wealth inequality? We have to go back to the Gilded Age and the tumultuous era of the late 19th and early 20th century when violence soared and a bomb went off on Wall Street (1920). Who is drawing analogies to unprecedented levels of wealth and income inequality triggering social disorder on a mass scale?

How about wealth inequality? We have to go back to the Gilded Age and the tumultuous era of the late 19th and early 20th century when violence soared and a bomb went off on Wall Street (1920). Who is drawing analogies to unprecedented levels of wealth and income inequality triggering social disorder on a mass scale? Where is the analog for extreme partisan divides in the nation? How about 1968, the year of the global revolution?From an informed historical perspective, all the predictions of a steadily rising stock market and improving economy look rather laughable, given the many extremes we conveniently write off as inconsequential. Sure, extremes can become more extreme without the system blowing a gasket, but to predict that extremes will have no consequences because we have safely stable analogs firmly in hand is to tempt fate with excessive hubris.Maybe we’ll get 1893, 1929, 1968, and 2008 analogs mixed into a heady cocktail of surprises.More By This Author:Everyone Loves A Generous Government Until They Have To Pay For It

Where is the analog for extreme partisan divides in the nation? How about 1968, the year of the global revolution?From an informed historical perspective, all the predictions of a steadily rising stock market and improving economy look rather laughable, given the many extremes we conveniently write off as inconsequential. Sure, extremes can become more extreme without the system blowing a gasket, but to predict that extremes will have no consequences because we have safely stable analogs firmly in hand is to tempt fate with excessive hubris.Maybe we’ll get 1893, 1929, 1968, and 2008 analogs mixed into a heady cocktail of surprises.More By This Author:Everyone Loves A Generous Government Until They Have To Pay For It

The Fed’s Empire Of Speculation And The Echoes Of 1929

Black Flag Friday: Could Black Friday Be A Harbinger Of A Tapped-Out Consumer?

Leave A Comment