This week has been a truly seminal one, and difficult to put into words the price action we have seen. Dramatic hardly does it justice, and yet this is the best I can do. Such events are rare, and it is at times like this we have to maximize the opportunities available, as these conditions cannot and will not last very long, since the market makers and insiders cannot afford to kill the goose that lays the golden egg. You can only frighten a market so much – violent and dramatic does the job, as the shakeout triggers panic selling and a rush to safe havens. And once the job is done, it’s time to mop up with further, but less pronounced moves to shake out any remaining weak holders.

In the last five days, we have seen two bouts of buying, the first on Tuesday, and the second on Friday just before the close of the US session, as denoted with the extreme volume and ultra deep wicks to the lower body of the candle on the YM emini daily chart. And as you would expect this is mirrored on the sister indices of the S&P 500 and the Nasdaq 100. And we are likely to see more, as further stock is accumulated before the inevitable longer term rally higher then gets underway.

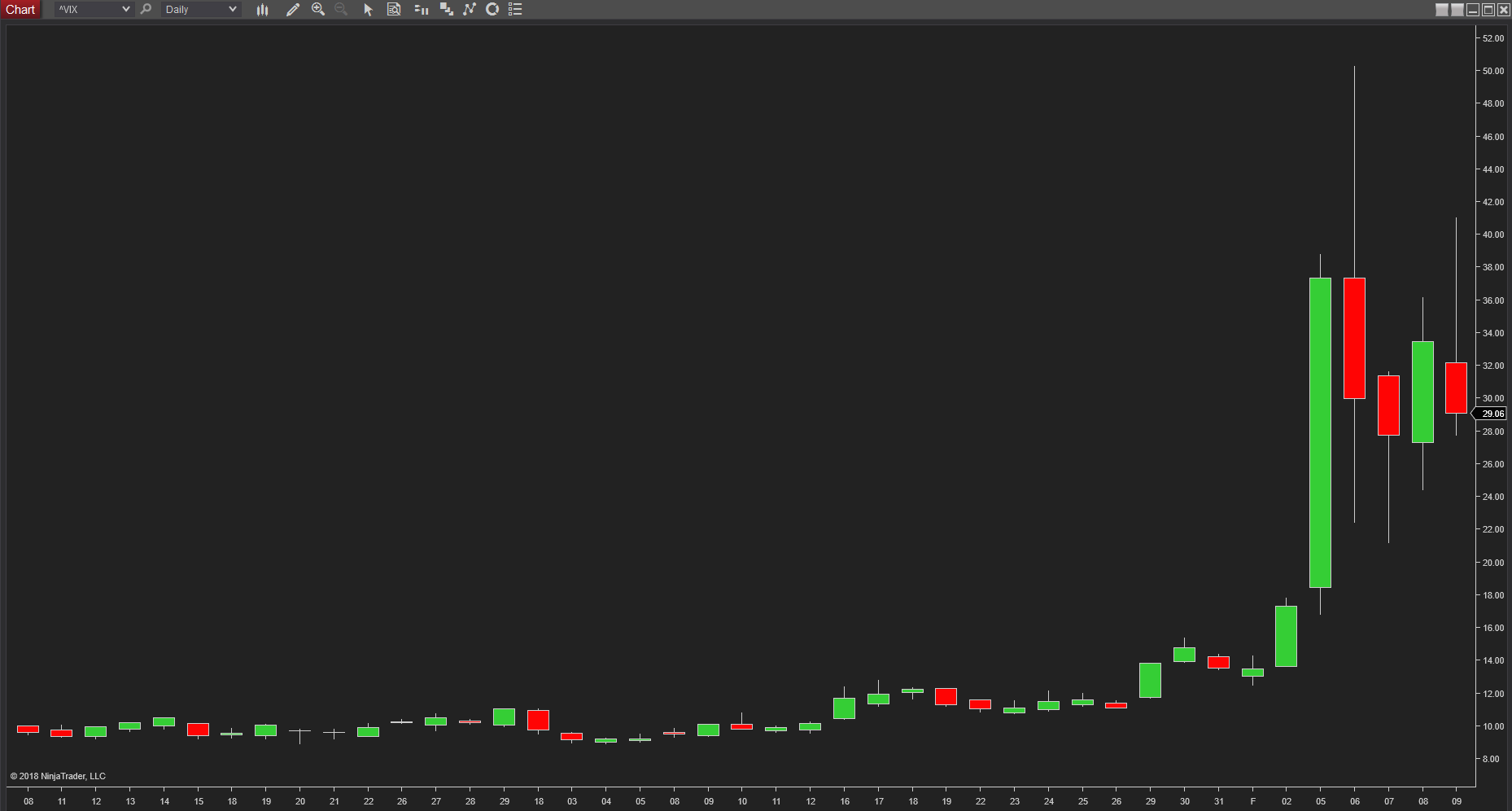

The VIX reflects this strong reversal, closing well off the highs of the session at 29.06 and with a very deep wick to the upper body reflecting this rapid shift in sentiment on Friday, having first climbed to over 40 at one point during the session. Expect to see the VIX calm somewhat next week, and potentially move lower and back towards 18/20 in the short term, and should the trend higher in equities develop as expected, a deeper move towards the complacent region of 12/11/10 in the longer term.

All of this will, of course, be reflected in the yen pairs which have been moving sharply lower over the week, but recovering as risk sentiment returned late Friday evening as the trading week came to a close. Much will now depend on how the Nikkei 225 and other Asia Pacific indices open post weekend, and should they pick up this bullish sentiment expect to see further gains in the Yen complex next week. However, just a reminder the Tokyo Stock Exchange is closed on Monday for the National Foundation Day holiday.

Leave A Comment