Earlier this year, two law professors at the University of California, Berkeley School of Law took issue with of all things Tobin’s Q. Though named for James Tobin, the idea had been introduced much earlier by several people. Tobin popularized one view of the concept. Robert Bartlett and Frank Partnoy objected to many of the contemporary uses.

To judge firm valuations, Tobin proposed a numerator consisting of the firm or asset’s market price. This would be divided by its replacement cost. The resulting ratio was supposed to tell us something about fair value.

It has been distorted over the years into many different practices. It has become common in law as finance to use the Q ratio as a reductive market-to-book ratio. It is even more common to impute meaning into this simplified construct. Bartlett and Partnoy warn:

Many of the problems arise because regressions that have as their dependent variable a ratio with book value in the denominator are likely to produce biased estimates, due to both omitted assets and time-varying, firm-specific characteristics that can systematically alter a firm’s book value. As a result, the simplistic version of q produces non-classical measurement error in regression specifications that seek to estimate the relationship between firm value and various corporate and regulatory phenomena.

The short version: book value isn’t so straightforward. It is the accounting world’s stand-in for what Tobin was once specifically seeking to measure. Book value isn’t always or exactly replacement cost, though in principle it might seem awfully close.

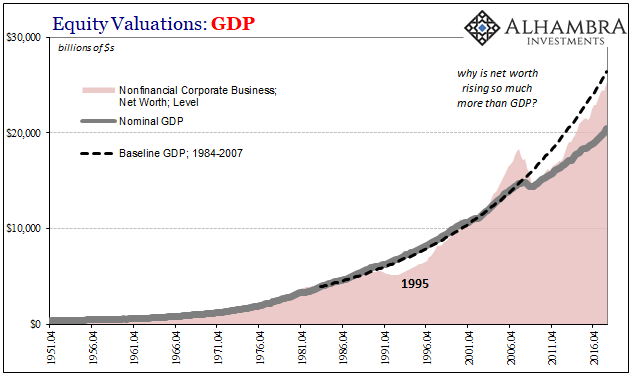

One standard use for this modern Q ratio is to value the stock market more broadly. Here we use the Federal Reserve’s Z1 estimate for non-financial corporate equities as its numerator, broadly speaking the market value of aggregate businesses in the corporate marketplace. At the denominator, we place corporate net worth, obviously non-financial as well and also pulled from Z1.

It’s not exactly book value but again it is close enough to the concept. Or it might seem.

On a big picture level, Tobin’s Q, this version, is meant to judge market valuations of equities keeping in mind tangible value; or what we might call wealth. These supply-side concepts pull together various factors such as profits, investing, and, perhaps most of all, opportunities and whether the business sector is taking, or will be able to take, the advantage of them.

The market is not the economy and the economy is not the market, my colleague Joe Calhoun always, always, always protests. And that’s absolutely true; but. One should be related in the long run to the other. That’s the point of things like the Q ratio, to judge whether or not there is too much future in the current market given the current economy. Too much extrapolation is dangerous, meaning risky. Joe’s right in that this is a long run rather than a short-run notion.

Leave A Comment