Sometimes the bond market gets it wrong too.

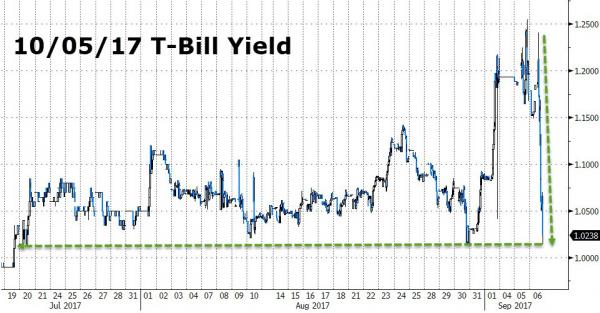

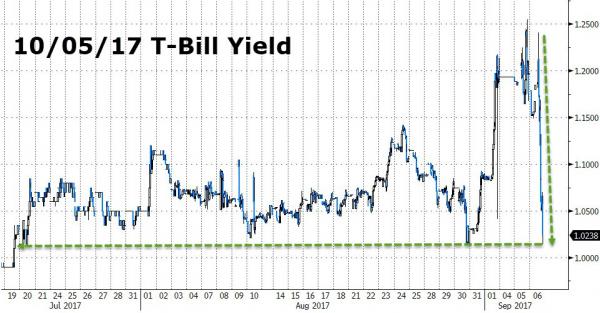

Earlier today, when Trump “flipped” on the GOP and aligned with congressional Democrats at a White House meeting to fund the government and raise the debt ceiling through Dec. 15. despite objections from virtually all Republicans, the threat of a late September/early October debt ceiling crisis disappeared. The bond market realized this first by sending the yield on the October 5 BIll tumbling from 1.20% to 1.00%, as repayment on this maturity was no longer in jeopardy.

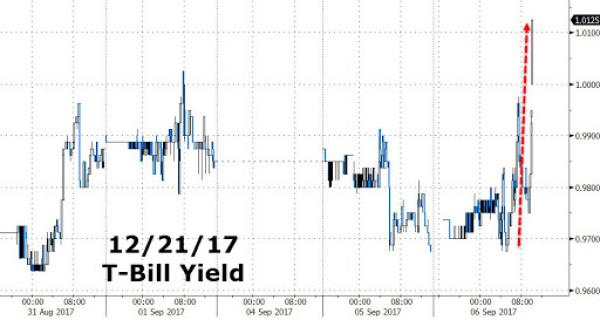

However, at the same time as the October T-Bill yield was tumbling, bond traders sent the December 21 T-Bill yield surging, since after all all Trump had achieved was kick the can by three months…

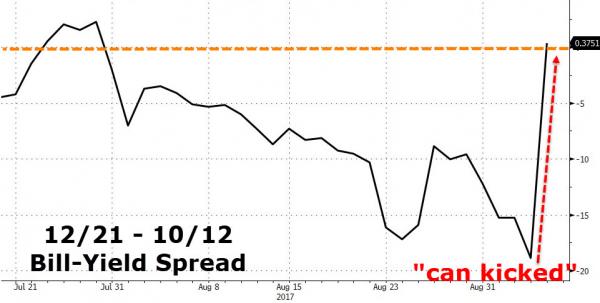

… which in turn inverted the Oct 12-Dec 21 curve.

There’s one problem with this kneejerk reaction: it was only half right, because while bond traders were right to buy the October bills, they made a mistake in dumping the December Cusip.

Why? The answer lies in the cash flow calendar.

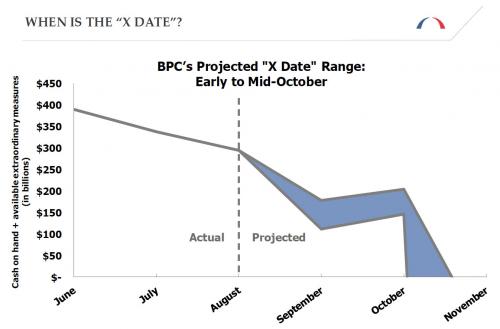

Recall that the reason why early October Bills were being sold is not because the “debt ceiling” would be breached – that happened in March of 2017, with a last minute agreement in May kicking the can through September, which in turn has now been pushed through December) – but because early October is when the Treasury’s “X-Date” would finally be hit: that’s the date when the Treasury would run out of cash and emergency measures.

The problem is that the upcoming three month extension to December 15 is not also an extension of the X-Date: there will be a buffer of at least a few months between December 15 and when the next X-Date hits.

As Jefferies’ Ward McCarthy explains, Congress’s standard operating procedure for addressing the debt ceiling over the past few years has been to suspend it for a defined period of time. Assuming that this agreement centers on a suspension of the debt ceiling through December 15th, the following will happen once President Trump signs the bill:

Leave A Comment