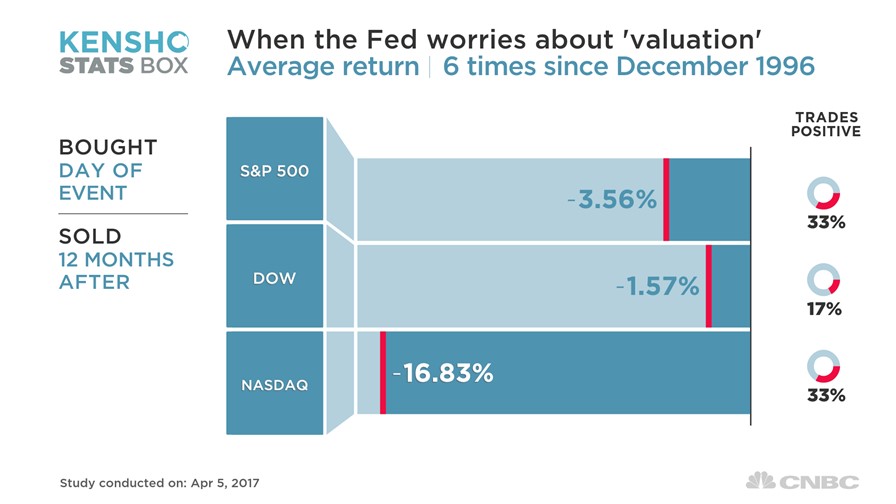

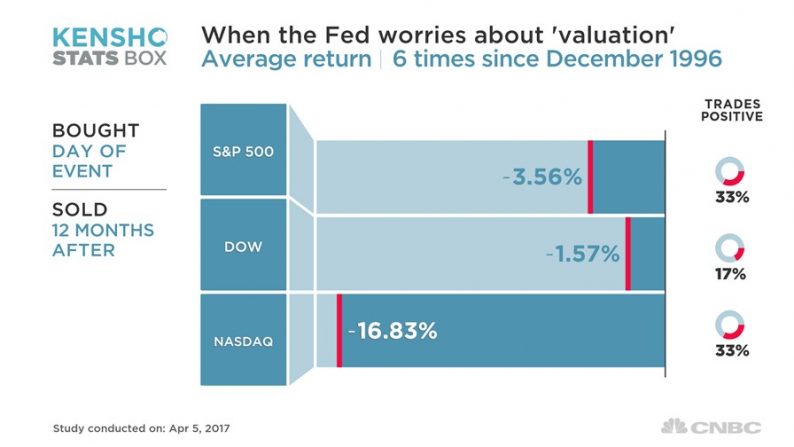

As I mentioned, the Fed said in its Minutes that valuations were ‘quite high.’ CNBC decided to do an analysis of how stocks performed one year after the Fed has said stocks were expensive because the Fed rarely comments on valuations. As you can see in the chart below, the Fed has commented on how expensive valuations were six times since 1996. If you look at the Shiller PE, the stock market has spent almost all the time from December 1996 until now above the median PE which is about 16. The only time it fell below the median PE was the depths of the 2008 bear market. Therefore, the Fed has been correct in its analysis.

The perspective on valuations should not be looked at in terms of twelve-month performance since valuations effect long term performance, not short term performance. Even with the analysis looking at too short of a period, the Fed’s statements were accurate as you can see in the chart below. The Dow was down 5 out of the 6 times the Fed said stocks were expensive and the Nasdaq was down an average 16.83% (because of the tech bubble burst).

The Fed’s analysis isn’t like a market forecaster would make because they set policy which effects the market. The Fed is also biased to the positive side because it doesn’t want to spook the market. The Fed hasn’t predicted any of the past few recessions in advance because it thinks predicting one would cause one. The Fed will only comment on valuations if they get way out of hand.

A great analogy to this situation is when Reed Hastings, the CEO of Netflix, commented on the high valuation Netflix stock had gotten to. As the CEO of the company, Reed doesn’t want to tell investors not to buy his stock. However, Netflix stock had risen to such insane valuations he felt the need to try to squash the bubble before it got bigger. A spiking and crashing stock price hurts the firm. The difference between Reed Hastings and the Fed is that the Fed has caused stock market bubbles through setting artificially low interest rates (below the Taylor Rule) while Reed Hastings didn’t cause Netflix to rise so quickly. In fact, the Fed also played a part if why Netflix’s stock has risen fast because of its QE and low interest rate policy.

Leave A Comment