Despite today’s unexpectedly strong ADP and ISM report, which however followed a disappointing Q4 GDP print, the FOMC meeting at 2pm should be largely uneventful. The Federal Reserve, which won’t have seen Friday’s payroll report yet, will only release its statement without a press conference or Summary of Economic Projections. This offers market participants less information to digest and react to, and therefore consensus expects no change from the Fed.

A quick reminder on what has happened in markets since the Fed’s latest, and only second in the past decade, rate hike which has seen the yield curve has flatten:

?

While gold has been the best performing asset class:

?

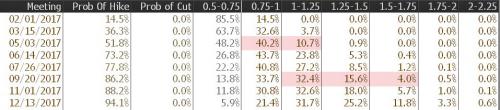

Although the odds of a move at this meeting are small, March is still a possibility with futures pricing in around a 15% chance of a 25bps hike.

?

Odds are slim as there is still a great deal of uncertainty surrounding the new President and his policies and the USD has been volatile as a result. In light of Fed rhetoric on the subject however, the Fed is not expected to give commentary to how, if at all, the potential Trump stimulus will affect the course of monetary policy.

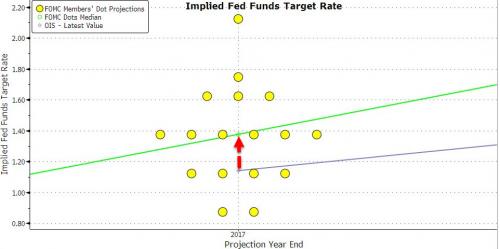

The median FOMC participant is expected to still call for three hikes this year, a divergence from the market’s less hawkish expectations (like in 2016). The three hikes priced by the Fed do not correlate with the two hikes priced with the market, as traders are more sceptical that they will be able to increase rates at that pace, given the uncertainty surrounding Trumps potentially protectionist policies.

?

One development the Fed have referred to several times, and with increased stress, is the potential deflationary affect from a stronger USD and weaker global demand. The inflation data has held up so far with the core PCE figure printing just 30 bps below the Feds mandate in December. Growth figures are less favourable for the Fed — with the advanced reading for first quarter printing well below analyst expectations (1.9% vs. Exp. 2.2%) but this will be played down by the Fed until later readings confirm this (earlier today the Atlanta Fed raised its Q1 GDP forecast to 3.4% from 2.3%). Employment remains strong as well and continues to be a pillar upon which the Fed rest the normalization process.

Leave A Comment