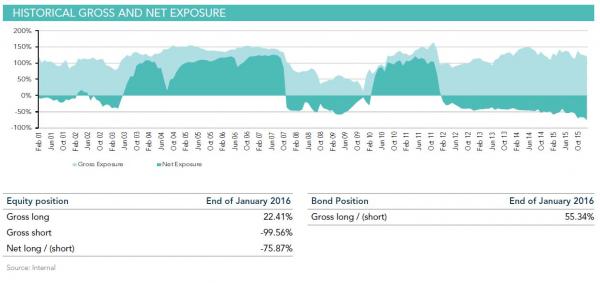

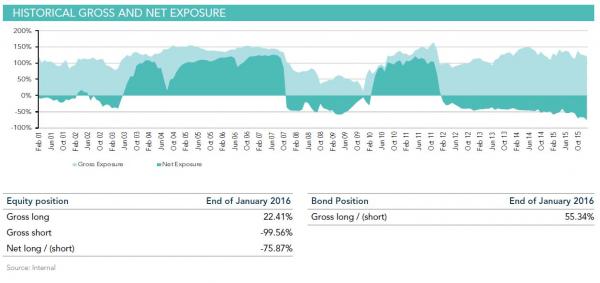

The name of Russell Clark and his Horseman Global hedge fund are well-known to regular readers: Clark is perhaps best known not only for having run a net short book since early 2012…

… but for being consistently profitable and successful during this period, a time when most of his “pedigree” peers have been underperforming the market and losing money hand over fist.

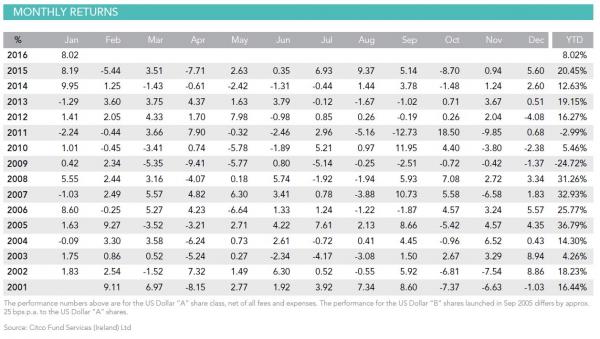

In fact, based on its size, one can probably argue that Horseman Global is the most successful hedge fund of 2016, if not of the entire decade.

His latest letter to clients can be found here.

The reason we bring Horseman Global up is not because his latest letter is out – we will share that once we have it – but because Russell Clark has released a fascinating white paper which seeks to answer the most important question of all: not if there is a bubble – by now everyone, even the central bankers, knows we are currently living inside the biggest asset bubble in history, but when does it burst.

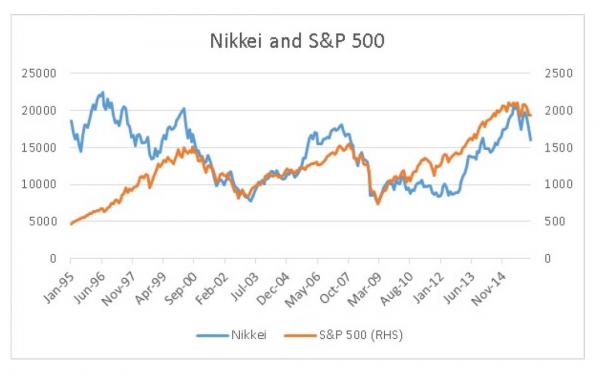

This is what he says in a letter that looks at the curious relationship between peaks in the Nikkei ant the S&P500:

“One of the curious things over the last few years, is that despite the last two bubbles in markets being mainly US centred (dot com bubble and US housing) it has been the Japan based Nikkei that has peaked 3 to 6 months before the S&P 500.”

Here is his full letter:

One of the curious things over the last few years, is that despite the last two bubbles in markets being mainly US centred (dot com bubble and US housing) it has been the Japan based Nikkei that has peaked 3 to 6 months before the S&P 500. The Nikkei peaked in March of 2000, while the S&P 500 rolled lower in August of that year. The Nikkei peaked in June of 2007, while the S&P 500 peaked in October of that year.

The question is why should this be the case? Most investors would argue that the US economy is larger than Japan, and its stock markets are larger and more liquid. Theoretically, the US market should lead the Japanese markets.

Leave A Comment