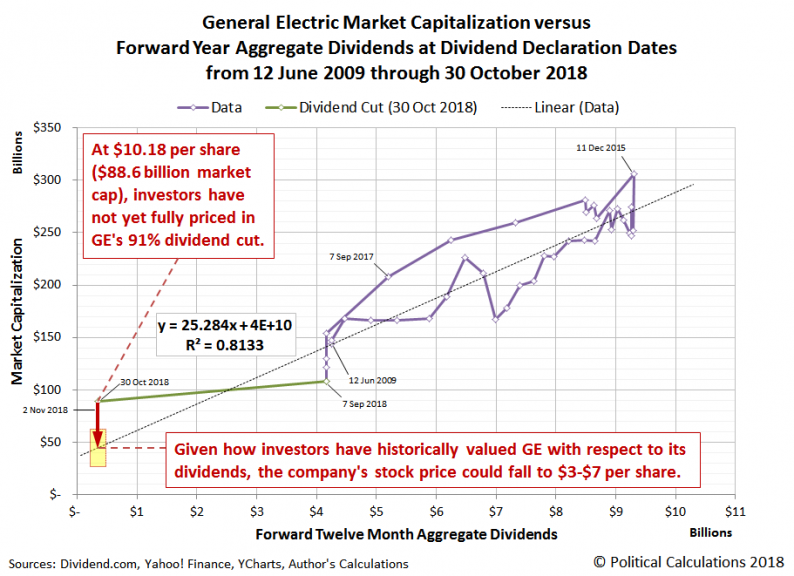

Now that General Electric (NYSE: GE) has slashed its quarterly dividend by 91%, from $0.12 to $0.01 per share, which we estimate is about 50% more than what investors had already priced in to the stock, what can they expect next for the company’s share price?

Based on the historic relationship that investors have set between the company’s market capitalization and its aggregate forward year dividends since 12 June 2009, we would anticipate GE’s share price falling to somewhere within a range of $3 to $7.

When GE’s announced its future dividend cut on 30 October 2018, which will take effect with dividends to be paid in 2019, the company’s stock price fell to $10.18 per share. Since then, the share price has continued to erode, where it has fallen into the single digits. In the absence of positive news, we would anticipate that erosion will continue until the share price stabilizes somewhere within our target range. That range is centered at about $45 billion of market capitalization, which corresponds with a share price of $5.14.

Alternatively, it is possible that the company’s stock price could be sustained at higher levels if its new CEO, Larry Culp, was overly conservative in his action to preserve the company’s cash by cutting its dividend. Given that GE’s credit rating has been cut by S&P, Moody’s and Fitch, we see that possibility as unlikely in the near term, where the reductions in its credit rating will mean higher borrowing costs going forward for a company that is awash in debt and which faces an SEC accounting investigation.

Data Sources

Dividend.com. General Electric Dividend Payout History. [Online Database]. Accessed 2 November 2018.

Ycharts. General Electric Market Cap. [Online Database]. Accessed 2 November 2018.

Yahoo! Finance. General Electric Company Historical Prices. [Online Database]. Accessed 2 November 2018.

Leave A Comment