Gold prices fell $1.38 an ounce on Monday as investors remained cautious ahead of the U.S. midterm elections and Federal Reserve meeting. Global stock markets were mixed yesterday. Gains in financial and energy shares pushed the Dow and S&P 500 higher, but the Nasdaq Composite fell. Last Friday’s strong jobs report bolstered the case for the Federal Reserve to raise interest rates in December.

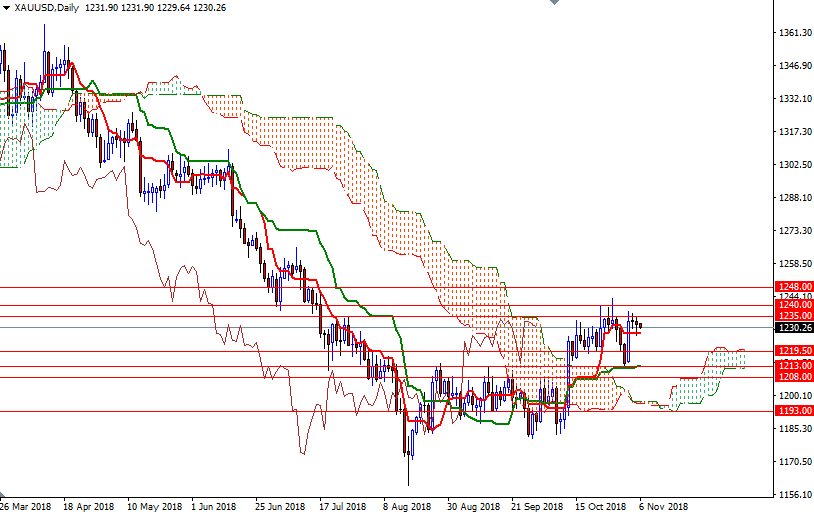

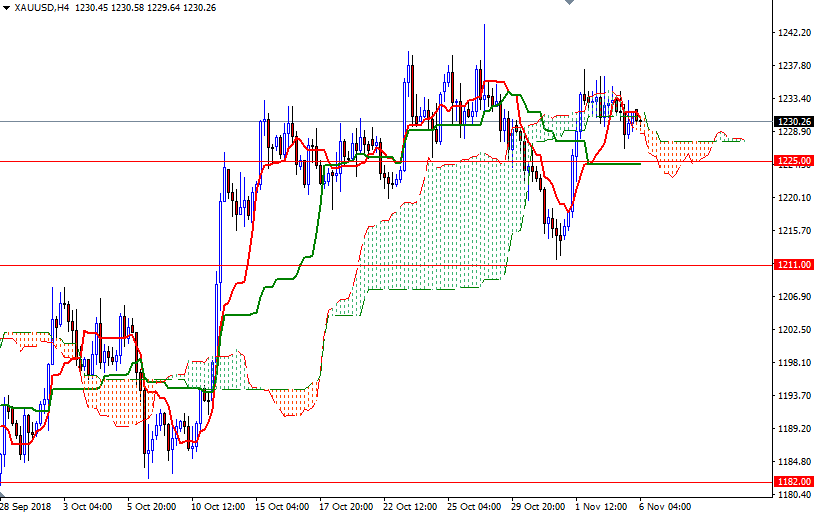

XAU/USD is above the Ichimoku cloud on the daily chart, but the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are flat. There is strong chart resistance just overhead that has capped rallies in recent weeks. A push above the 1240/35 zone would suggest that the bulls are ready for their next upside advance. If that is the case, look for further upside with 1245.50 and 1252/48 as targets.

To the downside, the initial support sits in 1228-1227.50, the daily Tenkan-sen. That is followed by 1225/4. Also, keep in mind that prices are trapped within the borders of the hourly cloud for the time being. The bears will need to drag prices below 1224 to gain momentum for 1220.50-1219.50. A drop below 1219.50 indicates that the market is targeting 1216.50-1215. If this support gives way, XAU/USD will retreat to the 1213/1 area.

Leave A Comment