TM editors’ note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

There are still winners in the energy space, but you have to move quickly. In advance of the rebalance U.S. Global Investors CEO Frank Holmes is expecting toward the end of 2016, he and analyst Samuel Pelaez point to the sectors taking advantage of opportunities, including refiners, midstream MLPs, low-cost producers, airlines and chemical companies. In this interview with The Energy Report, they name their favorites and outline the fundamentals that will make 2016 look a lot different than the year that just ended.

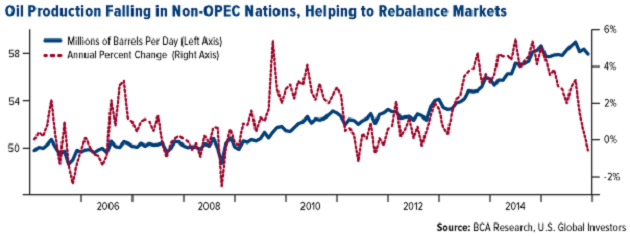

The Energy Report: In a recent Frank Talk, you quoted BCA Research with a prediction that oil markets will rebalance in 2016. What is that based on?

Samuel Pelaez: This chart shows that the U.S. has come off its peak production quite a bit. We reached peak production in April at about 9.6 million barrels (9.6 MMbbl). We’re about 400 thousand barrels (400 Mbbl) off from that level. This goes a long way to rebalancing the supply/demand dynamics globally. Even though the U.S. has been a major contributor to rebalancing the supply in the markets, we have not seen the supply come off to the levels we were initially expecting. We thought about 1.2 MMbbl could be curtailed, but only managed to get about 400 Mbbl.

One reason for the continued production is that banks are pressuring explorers and producers (E&Ps) to bring in cash flow. The only way for these companies to bring in more cash flow is to continue growing production, or at least maintaining production. On top of that, we’ve seen massive efficiency gains in shale productivity. So even though the rig count has fallen dramatically, the U.S. has been able to sustain production at a relatively good level, which actually bodes really well going forward, from a U.S. supply perspective.

Now, what really needs to change for a supply/demand rebalance is for OPEC’s volumes to stabilize. Toward the end of the year we saw that even though the U.S. was cutting production, OPEC production grew. In November, during their last meeting of the year, they unofficially abandoned their quota system, which they had brought from 30.5 MMbbl all the way up to 31.5 MMbbl. We saw 700 Mbbl of increased production come in toward the end of the year, which more than offset the U.S. supply volume. So even though we think supply is going the right way and OPEC’s boosted production may not be sustainable, we believe we’re coming to that point where supply will continue to erode gradually as a result of low oil prices.

More interestingly, on the demand side of the equation, China, the largest oil consumer, actually imported a record amount of oil in December, a total of 7.8 MMbbl of oil equivalent a day. That’s 16% growth month over month. It is clearly taking advantage of lower oil prices, and we expect that dynamic to continue going forward. The lower oil prices resulted in dramatic increases in gasoline consumption around the world. More importantly, China is expanding its strategic oil reserves to take advantage of this window of opportunity, which gives you a sense that it doesn’t think it is sustainable going forward.

Purchasing Managers Indexes (PMIs) are the best leading indicator for commodity demand, especially in China. As of now, global PMIs—including China PMIs—are in a negative downtrend. That means that the one-month number is below the three-month trend. Until that changes, we don’t expect a significant price recovery. However, as we go into the summer peak driving season and the peak oil demand season, we expect inventory draws. We’ve seen massive inventory build-ups. We may see that turnaround. That will make us more comfortable that prices have bottomed, supply growth will start outpacing demand growth and we will slowly and gradually move toward a rebalanced market toward the end of the year.

TER: Do your supply side calculations include Iran? What impact could that have when it starts shipping oil again?

SP: It’s actually very hard to forecast OPEC supply. But we do expect to see Iran volumes increase since sanctions were lifted. Iran has said it is ready to increase production by about 500 Mbbl. We think that is realistic. It believes it can grow to 1 MMbbl, which essentially will take it to pre-sanction level. We don’t expect it to go above that, considering the lack of investment over the past few years and that major significant investments will be required for Iran to be able to grow production back up to 4 MMbbl per day (4MMbbl/d). So yes, we do expect that to be a significant driver in terms of volumes earlier in the year; however, we don’t expect that to fully materialize. There are both upsides and downsides to this because it’s very hard to estimate what the market is pricing in, but we believe in Q1/16 and perhaps all the way until seasonal factors kick in during Q2/16 we’ll continue to see pressure on the prices down.

TER: Do you agree, Frank?

Frank Holmes: I do. I think that the pivot point is going to be the Federal Reserve trying to mitigate financial-meltdown bank lending in the energy patch. That could change the guidelines for asset sales. I think what’s going to happen is we’re going to get a bottoming, we’re going to see supply drop and we’re going to see all future funding for a lot of these operations come to an end, which will fast track this contraction in the energy supply in the U.S.

I also think Iran is a real threat. Costs are so much lower there. In the short term, money can be made meeting Iran’s technology needs. In fact, it needs Boeing Co. (BA:NYSE) planes. It needs parts. It needs all the necessary chemicals and upgraded drilling equipment for the energy space. So there will be many companies that are going to benefit, but that will still put pressure on energy prices.

Leave A Comment