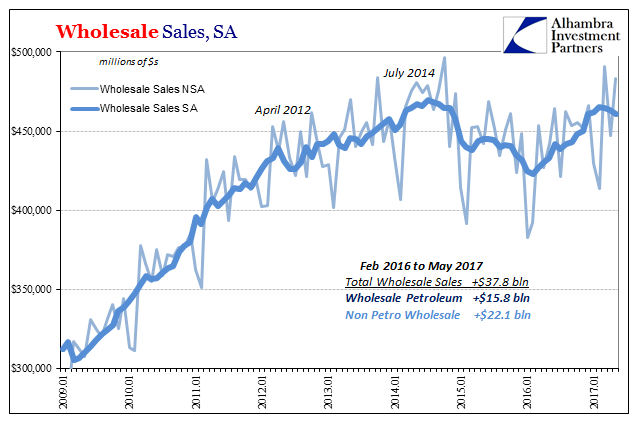

In the same way as durable goods orders and US imports, wholesale sales in May 2017 were up somewhat unadjusted but down for the third straight month according the seasonally-adjusted series. As with those other two, the difference is one of timing. In other words, combining the two sets, seasonal and not, we are left to interpret a possible recent slowing in activity. There are gains year-over-year to be sure, but it increasingly appears as if that growth was backloaded and limited to mostly the second half of last year.

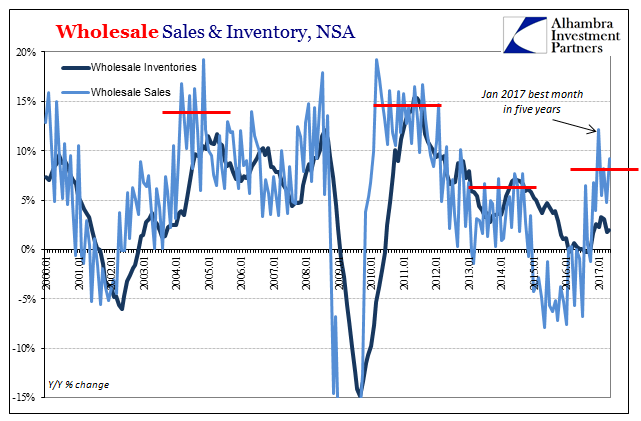

Year-over-year, wholesale sales were up 9.2% (NSA) in May, which actually betrays a lack of acceleration much like, again, durable goods and imports. Growth rates accelerated initially in the second half of 2016, but only to become positive numbers from what was nearly two years of contraction. Growth in sales seems to be stalling at around the same low level as in 2014.

That would appear to be the idea behind the seasonally-adjusted declines over each of the past three months. Peaking at $465.4 billion (SA) in February, wholesale sales have declined to a pace of just $460.1 billion in May. That is attributable to petroleum, where less is being sold and at a lower price (as one follows the other).

Outside of petroleum, wholesale sales haven’t grown, however. The seasonally-adjusted estimate for May ex petrol is only slightly more than February and still way off even the slowed 2012 trend-line.

On the other side of the ledger, inventories were up in May (SA) but less than March. Year-over-year, wholesale inventories have increased by about 2% the past few months. While that is less than the gains during much of 2015, it also follows what was in 2016 noticeable for its lack of liquidations. Inventory is therefore growing if slowly from an already very high level.

Excluding petroleum, the inventory-to-sales ratio is only slightly below the 1.40 mark that in the past has indicated conditions like recession. What typically occurs after reaching such an extreme is a rapid destocking process that in past recessions signaled the start of the recovery part of the business cycle.

Leave A Comment