Although there is no direct correlation between Gold prices and the stock market, they are usually inversely proportional. With stock market heading lower in 2016, gold prices have shot up considerably. Since I’m currently bearish on the stock market, I expect the market to continue its downward spiral. Hence, investors can find haven in gold stocks as increasing gold prices will probably push the stocks in the sector higher. One of my favorite picks in the industry is Barrick Gold (ABX)

Successfully achieving its annual goals

Barrick Gold performed very well in 2015, as the stock was up around 3.5%. 2016 was also off to a great start as Barrick Gold is up 70% year to date as well. The company recently reported its Q4 earnings indicating that there may be better times ahead for the stock. In the latest reported quarter, Barrick Gold’s EPS came in at $0.08, beating the analysts’ estimate of $0.06. Revenue of $2.24 billion also beat the sales estimates by $20 million.

According to the report, Barrick Gold successfully accomplished its yearly production target. The company posted the gold output of 6.12 million ounces, slightly more than its guidance of 6 million ounces annually. The company’s copper production touched 511 million pounds, which lies between its guidance of 480 and 520 million pounds. The successfully achieved goals will help to express some assurance in management.

Furthermore, Barrick Gold completed its strategy to reduce $3 billion from its debt previous year, which lightened its debt load. Recently, In January, the company sold its 50 percent interest in the Round Mountain project and its whole strut in Bald Mountain mine to Kinross Gold Corporation for around $610 million in cash.

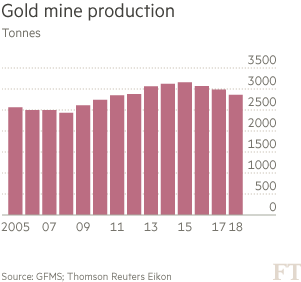

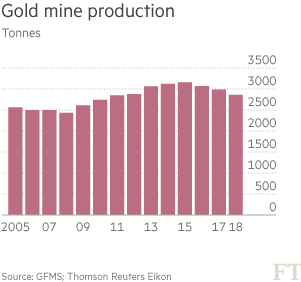

(Source: GFMS; Thomson Reuters Eikon)

With production likely to decline in the coming years, investors can expect gold prices to move higher. However, even if gold prices stay at the current levels, investors can expect Barrick Gold’s cash flow to increase due to declining production costs.

Leave A Comment