Inflation is commonly defined as “a general increase in prices and fall in the purchasing value of money.” For example, if a six-pack of beers cost $8 last year, but this year the same six-pack costs $16 then the annual inflation rate was 100 percent. This is because the price doubled for the same quality and quantity of beer.

To put it in perspective, the most famous hyperinflations occurred in Zimbabwe and in Germany. In 2003, Zimbabwe’s monthly inflation rate hit 7.96 x 1010 percent, and in 1923 the German government’s hyperinflation caused the exchange rate to rocket to 4.2 trillion German Marks to one U.S. dollar.

Two Definitions of Inflation

Using the common definition, Bitcoin is deflationary because Bitcoin’s purchasing power increases over time.

However, the traditional definition of inflation, according to the British Currency School, was an increase in the supply of money that was unbacked by gold. According to Reinhart and Rogoff’s This Time is Different, governments have been inflating currency over the past 800 years.

Originally, governments would inflate the currency by debasing gold coins. During the 20th century, government inflation technology advanced to printing presses, and currently, governments are able to inflate the monetary base by digitally creating money by updating internal databases that track fiat money, which is predominately digital.

Using the traditional definition, Bitcoin is inflationary because the supply of Bitcoin increases over time.

Gold Is Inflationary, Too

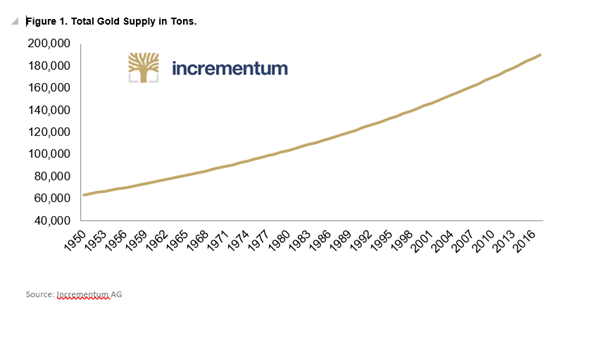

Gold is considered the ultimate store of value because of one specific characteristic: scarcity. No person or group can will gold into existence. Instead, the supply is controlled by nature. Figure 1 (above) shows the supply of gold has had a stable inflation rate. The creators of Bitcoin designed its inflation rate to mimic gold’s stable inflation rate.

Figure 2 (below) shows the circulating Bitcoin since its creation in 2009. As the inflation rate decreases, the price for each Bitcoin should increase, ceteris paribus. Bitcoin’s inflation rate was hardcoded into the software that operates Bitcoin. Hardcoding Bitcoin’s inflation is similar to Milton Friedman’s K percent rule that called for an algorithmic and regulated inflation rate that would eliminate human-error and the temptation to manipulate the monetary base for political reasons. However, Bitcoin’s inflation algorithm was designed to make Bitcoin even scarcer than gold.

Leave A Comment