Interview Of David Stockman By Henry Bonner at Sprott Global

Ronald Reagan and David Stockman

David Stockman was elected to Congress at age 29 back in 1976; he was an avid student of Austrian economics and supported a gold-backed money system and a balanced budget. He later joined the Reagan administration as Budget Chief, where he watched in awe as the Reagan administration quickly became the most profligate spenders in the history of the United States.

After leaving the Reagan Cabinet, he worked at the well-known investment house Salomon Brothers, and later co-founded the Blackstone Group alongside legendary hedge-fund manager Steve Schwarzmann.

In his most recent book, The Great Deformation: The Corruption of Capitalism in America, Stockman systematically repudiates and dismantles the myths surrounding the Fed’s supposed past successes at helping the US economy avoid major breakdowns, going all the way back to the crash of ‘29. Instead, as he explains, “Programs born out of desperation or idealism 75 years ago have ended up as fiscal time bombs like Social Security or as captive fiefdoms of one crony capitalist syndicate or another… Policies undertaken in the name of public good inexorably become captured by special interests and crony capitalists.”

The most important lesson I took from the book and the interview? Remember that there has never been a time of such profound debt saturation, coupled with intense crony capitalism, as today. No one has ever been here to tell how it turns out. We truly are in an unprecedented era…

David, can you explain how the ‘Fed put’ works on the stock markets and bond markets? How exactly does it translate into artificially higher stock prices and lower interest rates?

The Fed injects massive amounts of liquidity into Wall Street through the dealer system – that is, the 21 authorized treasury-bond dealers. The liquidity comes in the form of new credits to their bank accounts supplied by the Fed in return for the governments bonds, notes and bills, and even the GSE (Government-sponsored entity) obligations that it buys from them. The credit that the Fed supplies to the dealers is manufactured out of thin air; therefore it expands total credits and liquidity in the system. The dealers use it to buy other types of securities – stocks, bonds, derivatives positions and so forth.

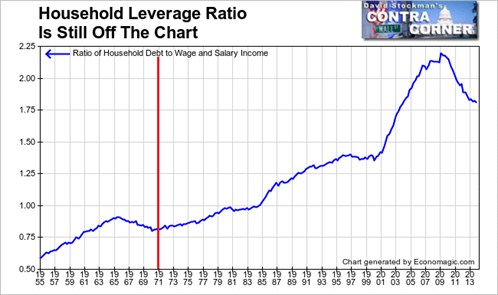

Historically, the purpose of the Fed’s open-market intervention in this form was to encourage the banking system to extend credit to the business and household sectors, thereby stimulating economic growth, as predicated by the Keynesian model. That was always a one-time parlor trick, however, because with each cycle of easing leverage ratios in the business and household sectors were ratcheted steadily higher. Household debt ratios, for example, went from 80 percent of wage and salary income prior to 1975 to 220 percent by 2007.

The problem today is that we have reached ‘peak debt.’ The household sector has $13.3 trillion of debts1, even after the modest post- crisis deleveraging; the ratio is still sky-high at 180 percent of wage and salary income.

Consequently, the household sector has been unable to borrow more money, no matter how much credit the Fed has injected through the dealers. That’s very different from where this whole Keynesian financial bubble started 40 years ago when we had, more or less, clean household balance sheets.

Underlying this domestic debt spree is the crucial fact that Nixon fundamentally changed the monetary régime in 1971; he closed the gold window, letting the Fed operate in an unfettered way. Household credit began to rise inexorably with each of the Fed’s easing cycles, until it reached the 2007 peak.

Today, money printing is not working in the traditional sense. It is not stimulating additional credit, spending, or ratcheting up the borrowing of the household sector because we have reached a condition of “peak debt”. In essence, the credit channel is now clogged and broken. Accordingly, the Fed’s injections of liquidity never leave the ‘canyons of Wall Street,’ to use a metaphor. Instead, it has essentially fuelled more carry trades and speculative buying of financial assets – stocks, bonds, derivatives, commodity futures, and so forth.

Leave A Comment