CSI Compressco LP (CCLP) surprised many income investors last week when it announced a 50% cut to its distribution, sending its stock price tumbling by nearly 20%.

The company has been in business for more than 45 years and paid steady dividends until 2016, adding to the surprise and disappointment.

However, CSI Compressco was sending off a number of warning signals well in advance of its dividend cut.

Let’s take a closer look at the business and learn how income investors can avoid painful situations like these in the future and stay focused on safe high dividend stocks instead.

Business Overview

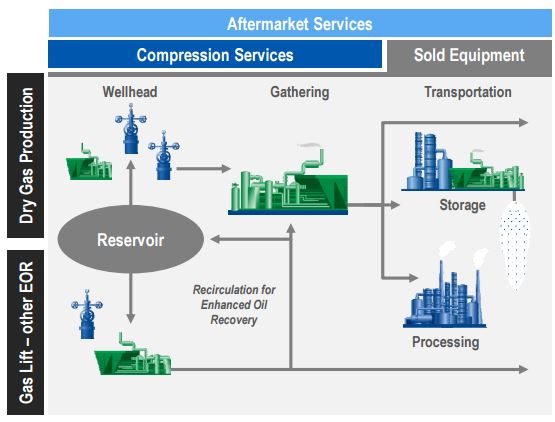

CSI Compressco provides compression services and equipment for natural gas and oil production, gathering, transportation, processing, and storage.

Natural gas compression is a mechanical process that is essential to the production and movement of natural gas.

Natural gas needs to be compressed for efficient processing, transportation and storage. By reducing the volume and increasing the pressure, pipeline systems can support much higher gas flow rates.

As you can see, compression is necessary throughout the full natural gas production and sales cycle, from the wellhead all the way through pipelines and storage facilities.

Compression is also a lift technique used for producing oil that otherwise has insufficient reservoir pressure.

Source: CSI Compressco Investor Presentation

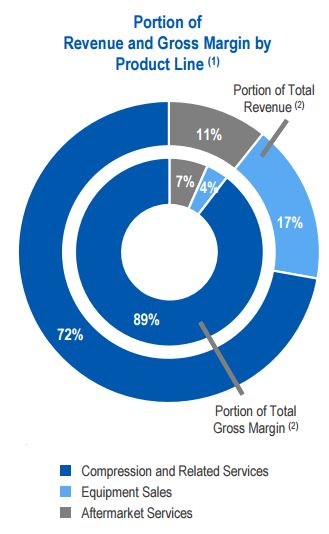

CSI Compressco primarily makes money by providing compression services through fee-based contracts for its fleet equipment and personnel. Equipment sales and aftermarket services only account for 11% of the firm’s total gross margin.

The compression business has several appealing attributes. For one thing, compression is required numerous times throughout the value-chain from production to consumption.

It is also an essential service for production and midstream infrastructure, helping support continued demand throughout various commodity price environments.

CSI Compressco’s service contracts provide fairly predictable cash flow and extend to an average of more than 40 months on location.

As U.S. natural gas production continues to increase over the coming years thanks to the shale boom, demand for compression services is expected to rise, too.

Leave A Comment