Even as OPEC signaled that it may continue to restrict production during the second half of 2017 oil prices fell by more than 7% last week, their worst decline in about a month…so why did oil prices fall, and why are oil ETFs among the worst-performers this year?

Written by Sumit Roy (ETF.com)

…Key OPEC sources recently suggested that the cuts are likely to be extended. Kuwait’s oil minister, who expects the supply agreement to be renewed for another six months, said that he is satisfied with the compliance from OPEC and non-OPEC countries.

Why Energy ETFs Are Struggling

All else equal, an extension of the supply reduction agreement is positive news for oil prices. Why then did oil prices fall, and why are oil ETFs?such as the United States Oil Fund (USO), down 12%, and the Energy Select Sector SPSDR Fund (XLE), down 9.3%?among the worst-performers this year?

The answer to the above question has two parts:

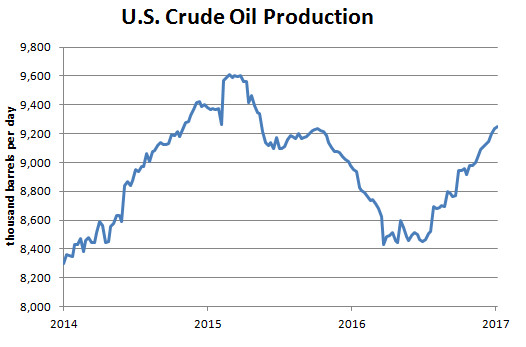

The Energy Information Administration reported that last week, U.S. output of crude oil climbed to 9.3 million barrels per day, the highest level since Aug. 2015 and up 800,000 barrels per day from where it was as recently as October.

That puts U.S. production on track to surpass the 30-year highs of 9.6 million barrels per day reached in 2015.

OPEC Could Still Succeed

U.S. producers are, in effect, throwing a monkey wrench into OPEC’s plans but that doesn’t mean the plan won’t succeed. According to analysts at Citigroup, inventories will eventually draw down as the OPEC cuts continue. Said analysts at the bank:

Leave A Comment