Benjamin Graham, widely considered the father of value investing, once said, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

In other words, over short periods, markets tend to move irrationally along with market psychology. But over longer market cycles (at least 10 to 12 years), fundamentals are ultimately what matter.

Since 1996, the U.S. stock markets have acted almost entirely like voting machines. Only during brief bear markets and corrections do they seem to act like weighing machines.

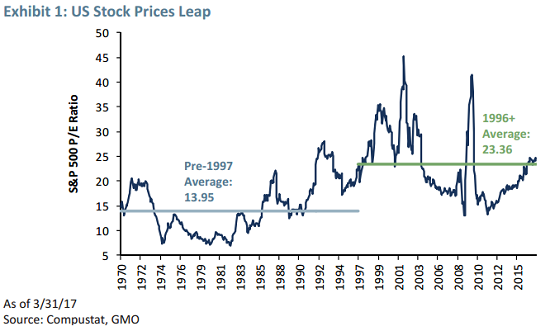

The chart below shows the average price-to-earnings ratio of the S&P 500 since 1970.

Source: Barron’s

As you can see, for the last two decades, stock market P/E ratios have been elevated most of the time. Since 1996, the average P/E has been 23.36. Meaning that stocks are almost always expensive. And dividend yields are almost always low.

Only during brief and sporadic crashes and corrections do we get a chance to buy stocks at bargain prices.

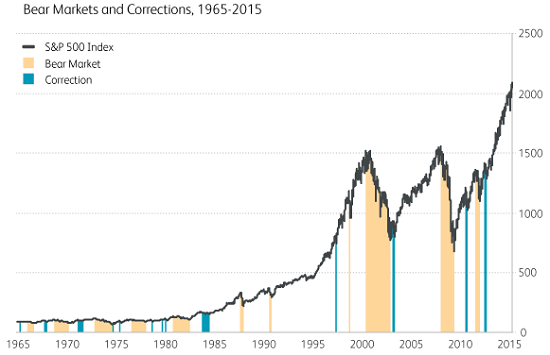

The average bear market lasts around 15 months (since 1900), though they vary widely. The crashes happen fast, while the bull markets take years to peak.

Source: Wealthfront (Editor’s note: the S&P is up another 20% from 2015.)

Now, once again, we find ourselves facing historically pricey stocks pushing higher and higher.

Clearly, it’s good to own some stocks for the long run. So you can either “dollar cost average” into it (invest the same amount monthly over years), or try to time it using stops and/or gut feeling.

Both strategies can work, but they have their own drawbacks. Dollar cost averaging into stocks means that you’re overpaying most of the time.

Trying to time the market is difficult and can be terrifying.

Personally, I use a combination of the two for stocks. I mostly dollar cost average into stocks I want to own forever. But I do hold onto more cash when stocks are pricey, take some profits, and wait for a correction or crash. It’s the modern version of value investing.

Leave A Comment