By now you have probably read everything about the death of high yield bonds, the investor lockup at Third Avenue, and the risk that these “junky” assets pose to exchange-traded funds. Believe me, the financial media is just getting started slicing and dicing this thing up. Everyone loves to sink their teeth into an investment that is tanking. It makes for great headlines and offers a curiously similar effect as gliding by an accident on the freeway. Despite our best intentions, we all slow down to take a peek.

As an avid watcher and owner of ETFs, I have been closely monitoring the price action of the iShares iBoxx High Yield Corporate Bond ETF (HYG) and SPDR Barclays High Yield Bond ETF (JNK) this year. These two ETFs represent the lions share of the below-investment grade fixed-income space, with combined assets of $25 billion.

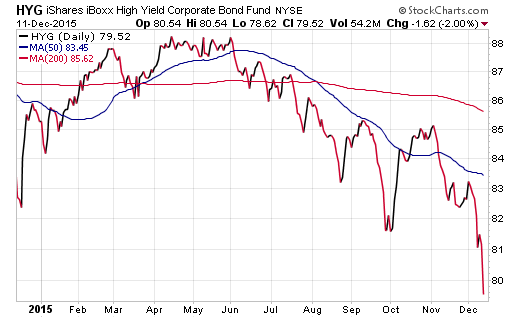

HYG is now down nearly 10% from its 2015 high and currently sports a 30-day SEC yield of 7.20%. That yield has been steadily rising as the price of the bonds in the underlying portfolio have been falling.

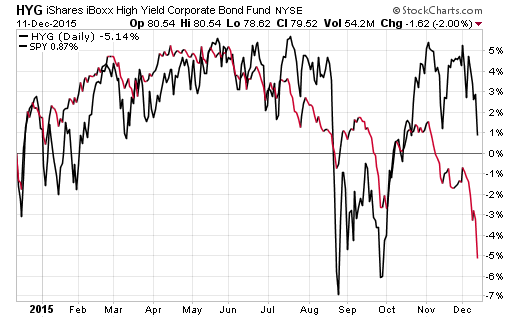

The biggest concern in this fixed-income sector has been the decoupling from U.S. equity markets.

The SPDR S&P 500 ETF (SPY) is 5% off its high and still in the middle of its 52-week trading range, while high yield bonds continue to make new lows. That is uncharacteristic of the typical correlation between these two asset classes and has many wondering if stocks are going to follow lower or junk bonds will ultimately rebound.

You would probably be hard pressed to find anyone admitting to owning these investments at this stage of the game. However, there are literally millions of investors who own some form of junk bonds. That may be through direct exposure in a fund such as HYG or indirectly through diversified corporate funds, aggregate indexes, bank loans, or a multi-asset fund structure.It’s become an ubiquitous part of the chase for yield over the last several years and far more common than most investors understand.

Leave A Comment