We’ve pointed out the flaws in the price to earnings (PE) ratio many times before. Chief among these flaws is the fact that the accounting earnings used in the ratio are unreliable for many reasons:

Photo Credit:Barbara Krawcowicz (Flickr)

It should come as no surprise that empirical research shows accounting earnings have almost no impact on long-term valuations.

No Correlation Between Earnings And Value

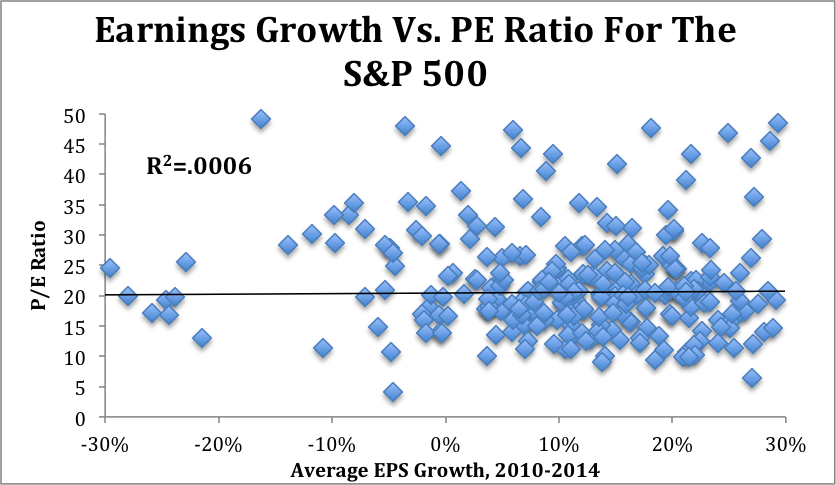

If accounting earnings actually drove valuations, then companies with high EPS growth should command higher multiples, and companies with low or negative EPS growth should have lower PE multiples. As Figure 1 shows, this correlation is nearly nonexistent.

Figure 1: EPS Growth Has Almost No Impact On Valuation

Sources: New Constructs, LLC and company filings.

The r-squared value of 0.0006 in Figure 1 shows that EPS growth over the past five years explains less than one tenth of one percent of the difference in price between stocks in the S&P 500. Stocks can see their PE multiples expand and contract in a manner that has almost nothing to do with changes in EPS, which makes looking at these metrics a poor indicator of valuation or future returns.

The Market Cares More About ROIC

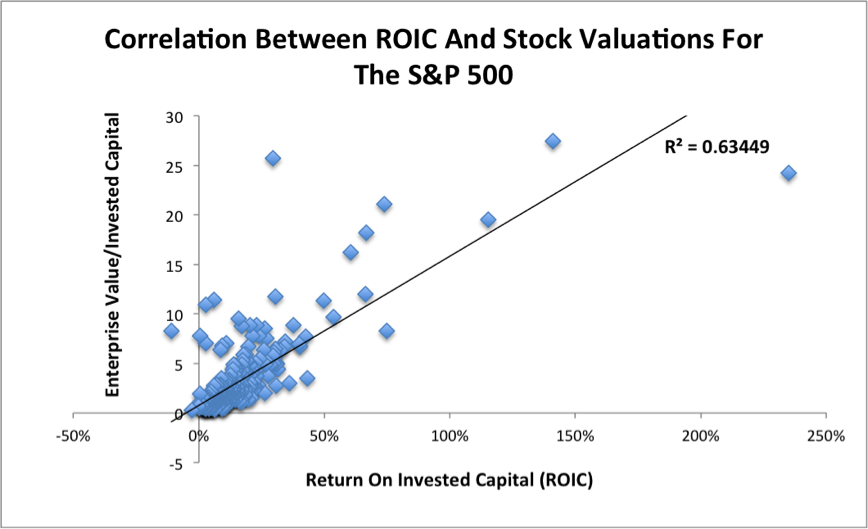

Many other studies have found the same lack of correlation between earnings growth and stock price. Instead, we find that valuations tend to be driven largely by return on invested capital (ROIC). Figure 2 shows that ROIC is highly correlated with Enterprise Value/Invested Capital (a cleaner version of price to book).

Figure 2: ROIC Is The Primary Driver Of Stock Price

Sources: New Constructs, LLC and company filings.

Leave A Comment