What do we have to be thankful for?

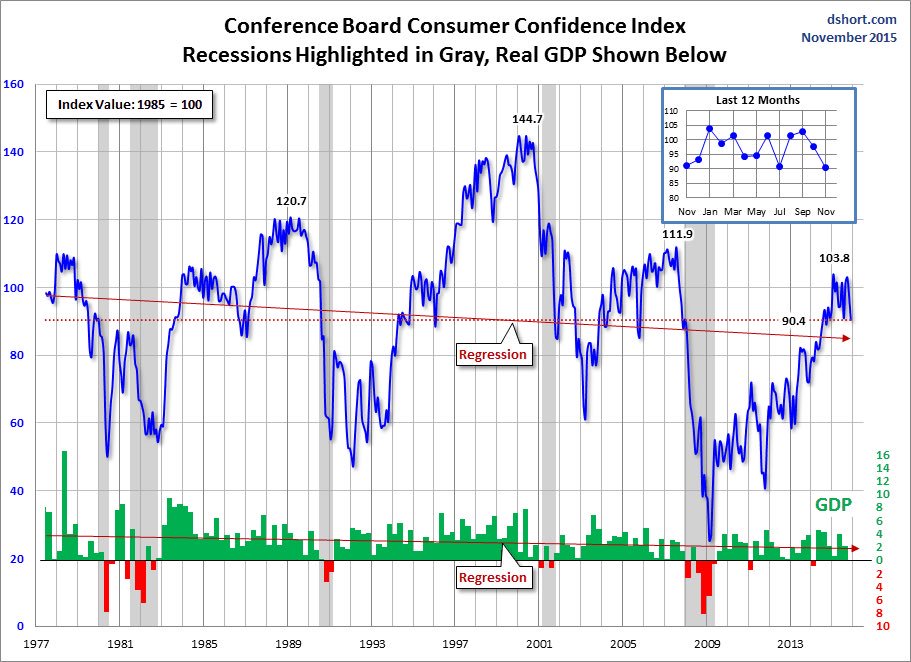

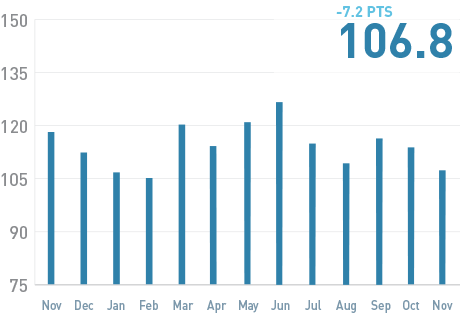

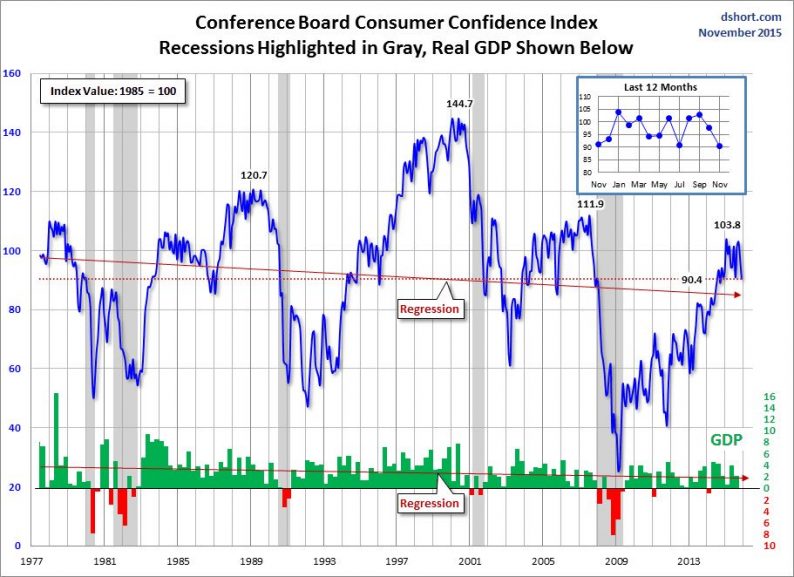

We should be very thankful that even a horrific terror attack on a major Western city becomes yet another reason to rally the markets. Oil prices shot up 5% yesterday but we rallied just as hard as we do when they fall – one is good for XOM, CVX and others and the other is good for consumers, whose confidence fell 10% between October and November and that was BEFORE the terrorist attacks we are not at all worried about.

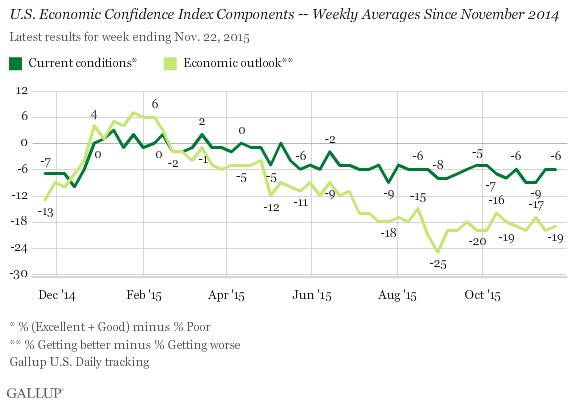

Sure, what do consumers know? Their spending barely makes up 70% of our GDP so why pay attention to their mood when there are stocks to buy, right? Economic Confidence is also fading fast and confirms the poor consumer numbers but hey – we’re only 50% lower than we were last December – I’m sure we’ll be fine if we just ignore it…

Norway’s Consumer Confidence is also fun to ignore:

Investors probably don’t know anything either so we can also ignore State Street’s Investor Confidence Index as it re-tests the year’s lows.

See – isn’t it fun to ignore things! Even Europe is ignoring things as their markets are fully recovering from yesterday’s drop this morning. How silly of us to think that any market sell-off would be allowed to stand!

Clearly our leaders are too TERRIFIED to let the markets even have a normal correction for fear that we all melt-down like China, which has been struggling since October to get it’s act together (we’re short FXI at $41):

Nobel Prize-Winning Economist, Joe Stiglitz has agreed with my premise (see Friday’s post) that Mario Draghi is full of crap and that his is merely “papering over the cracks that are caused by the faulty design of the currency bloc.” According to Stiglitz (and myself), Draghi’s assurances that he will do “whatever it takes” to boost the Euro-Zone’s economy simply distracted markets from a deficient system.

Leave A Comment