Once bitten, twice shy. That’s the attitude that investors tend to take with companies that slash or eliminate their dividends, and with good reason. If you are buying a stock with the intention of using the dividend to pay your living expenses, a dividend cut can take a wrecking ball to your retirement plans.

So it is that income investors fell out of love with iconic American blue chip General Electric (GE). During the pits of the financial crisis, with the venerable old company had to go begging to Warren Buffett for cash, GE cut its quarterly dividend from $0.31 to just $0.10 in early 2009.

Now, I certainly understand why GE did it. When you’re in bad enough financial shape to justify paying Mr. Buffett a 10% perpetual preferred-stock dividend, it makes prudent business sense to cut the common dividend. But income investors have long memories, and many are going to find it hard to trust General Electric with their retirement again.

But now that more than six years have passed since GE took a machete to its payout, I can say that it’s finally safe to trust GE’s dividend again.

Let’s dig into the details. At a current dividend yield of 3.7%, GE is one of the highest-yielding stocks in America outside of “traditional” income sectors like utilities, telecom, or tobacco. The GE dividend, at $0.23 per share, is still well below its old pre-crisis high of $0.31. But to GE’s credit, the company has raised its dividend by 130% since 2009. So GE has clearly made it a priority to reward its long-suffering shareholders with solid dividend hikes.

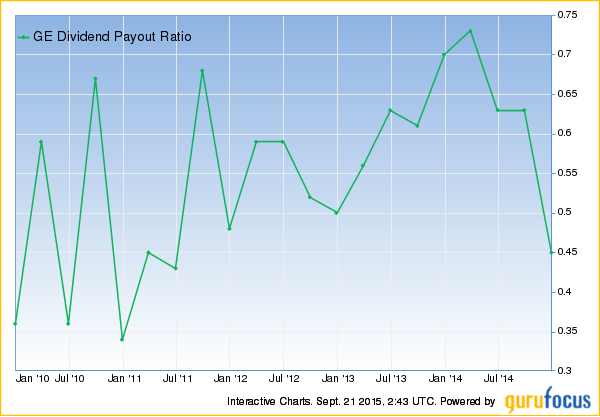

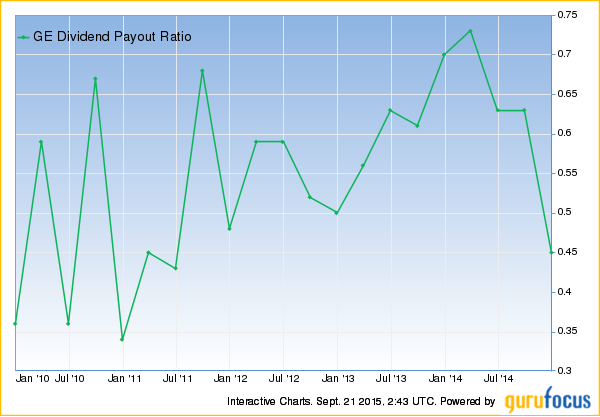

Over the past five years, GE has raised its dividend at an 11% compounded annual clip. And there is every reason to believe the dividend is safe for the foreseeable future. General Electric’s dividend payout ratio, at just 45%, is near the bottom end of its range of the past five years.

But the real reason to have a little faith in GE’s dividend is that this is a very different company than the one that slashed it back in 2009. Pre-crisis, GE had essentially morphed into an enormous Wall Street bank that also happens to run an industrial business on the side. In fact, the U.S. regulators deemed it a “systemically important financial institution” due to the size and scope of GE Capital’s operations. As recently as two years ago, GE Capital, as a standalone institution, would have been the seventh-largest bank in America.

Leave A Comment