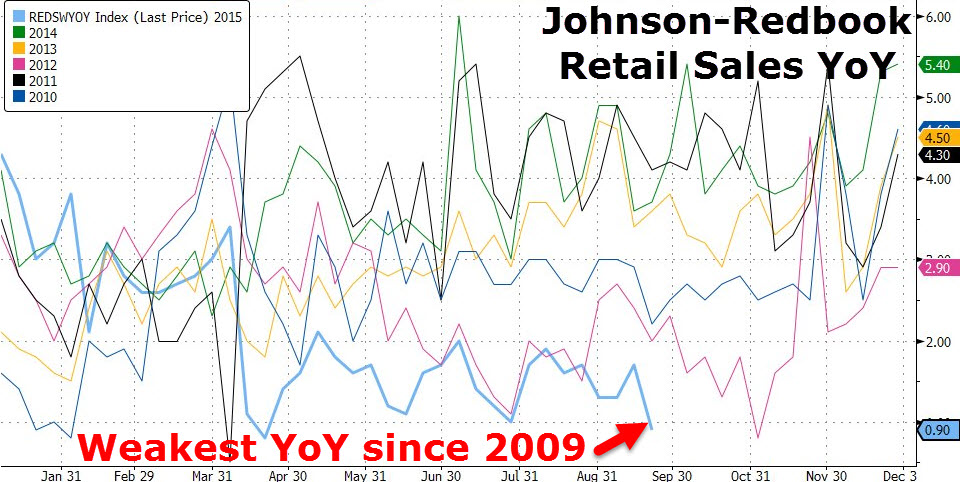

The last time September Retail Sales growth was this weak was 2009, limping aimlessly out of the ‘Great Recession’. With a mere 0.9% year-over-year growth, Johnson-Redbook data seems to confirm what Reuters reports is looming – the weakest U.S. holiday sales season for retailers since the recession. Consultancy firm AlixPartners expects sales to grow 2.8-3.4% during the November-December shopping period compared with 4.4% in 2014, based on analyzing consumer spending trends so far this year, noting (myth-busting for permabulls) dollars saved at the pump are being directed to personal savings or on non-retail activities.

This year is already seeing the worst retail sales growth since the great recession…

And now, as Reuters reports, the holiday season is setting up to be a major disappointment…

Upper middle-class shoppers spooked by a whipsawing stock market and shoppers waiting till the last minute for the best deals could result in the weakest U.S. holiday sales season for retailers since the recession, AlixPartners said.

The consultancy firm said it expects sales to grow 2.8 percent to 3.4 percent during the November-December shopping period compared with 4.4 percent in 2014, based on analyzing consumer spending trends so far this year.

This forecasted increase is on the low end of holiday sales performance since 2010,AlixPartners said in an advanced copy of a report given to Reuters. Holiday sales have averaged 3.9 percent in the last five years, the firm said.

“What we are seeing is that consumers’ behavior this year in terms of increased retail sales is fairly muted,” said Noam Paransky, director of AlixPartners’ retail practice and one of the authors of the report.

“A lot of the ingredients that drive retail revenue…aren’t there,” he said pointing to slow U.S. economic growth, low inflation and population growth.

U.S. consumer sentiment hit its lowest in a year in early September as households expected slower growth abroad to hit the U.S. economy, a survey released by the University of Michigan showed. Consumers’ expectations for current and future personal finances also took a knock.

Even though unemployment levels are decreasing and gas prices are falling, stagnant wage growth is forcing middle- and low-income consumers to spend prudently, Paransky said.

Dollars saved at the pump are being directed to personal savings or on non-retail activities, such as holidays, instead of discretionary items.

Leave A Comment