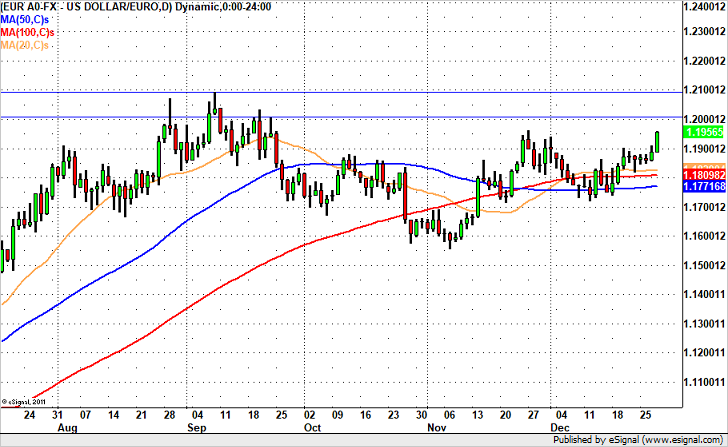

One of the best performing currencies today was the EUR/USD. The euro found support from the ECB economic bulletin that described the “euro area economic expansion to be solid and broad-based across countries and sectors.” They also said “underlying inflation is expected to rise gradually over the medium term.” U.S. data was weaker with the trade deficit rising rather than narrowing as economists predicted, putting pressure on the greenback. Although manufacturing activity in the Chicago region accelerated jobless claims ticked higher. All of these factors helped to drive EUR/USD above 1.1950, capping a year of solid gains.

On a technical basis, 1.20 is the next level to watch. There’s a very good chance EUR/USD will make it to that target rate and possibly even settle between 1.20 and 1.21. Momentum is certainly on the side of euro bulls and after a period of consolidation, we usually see a 3 to 5 day rally.

Leave A Comment