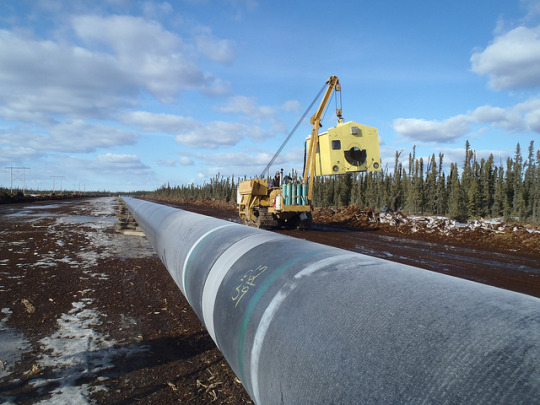

Photo Credit: jasonwoodhead23

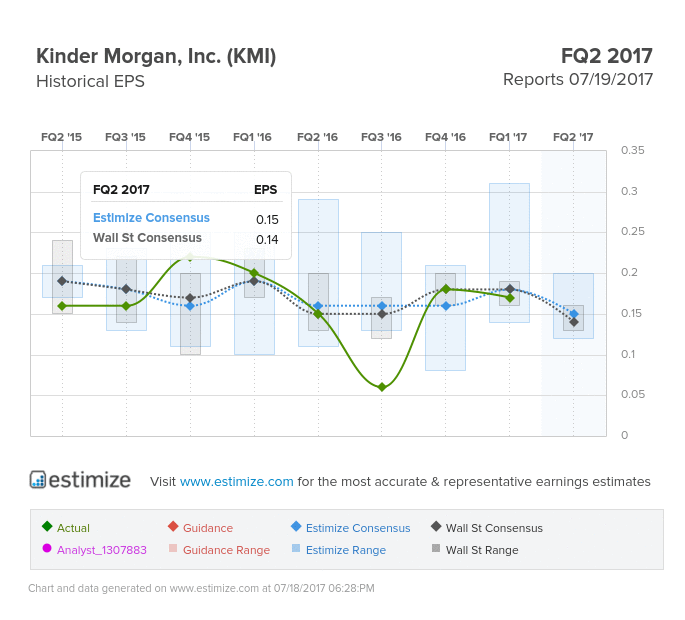

Kinder Morgan (KMI) is showing a 4% difference in Estimize and Wall Street estimates for EPS and a 2% difference between the two for revenue. Estimize comes in at $0.15 per share and Wall Street $0.14. For revenue, Estimize predicts $3.174B and the Street predicts $3.122B. KMI has a dividend yield of 2.56% and a P/E ratio of 64.4.

Kinder Morgan owns the largest network of natural gas pipelines in North America. The company makes 91% of their revenue from the stable fees they charge for their pipelines. In 2017, KMI outlined their objectives to initially internally fund all of their projects until it lined up enough partners to fund the project. To accomplish this, the company made two power moves that solidified their plan. First, they sold 49% of their interest in Elba Liquefaction Company (ELC) to EIG Global Energy Partners. In return, EIG pledged to fund 49% of the remaining $1.3 billion dollar pipeline expansion KMI was working on. Furthermore, the company went public in Canada using an IPO option, raising $1.75B by selling 103 million shares in Kinder Morgan Canada Limited. This move allowed them to finance their Trans Mountain project.

Not only is Kinder Morgan continuing to take over the pipeline industry, but they are also making power moves that are definitely appealing to investors.

Leave A Comment