Following the first full week of trading in 2018, the S&P 500 is up over 3% for the first nine days of trading in the new year. That index is edged out by the Nasdaq Composite Index, which saw a boost following the tech-heavy news flow last week spinning out of CES 2018. That annual event is a bevy of confirming data points for our Connected Society and Disruptive Technologies investing themes, and subscribers to the Tematica Investing newsletter saw several positions on the Select List move higher in response.

Even though we have this week yet another shortened trading week, we will still see a be pronounced pick up in 4Q 2017 earnings reports and more economic data that will factor into 4Q 2017 calculations. Also on hand will be a first glance at how the economy is performing in 2018. Now let’s get down to business.

On the Economic Front

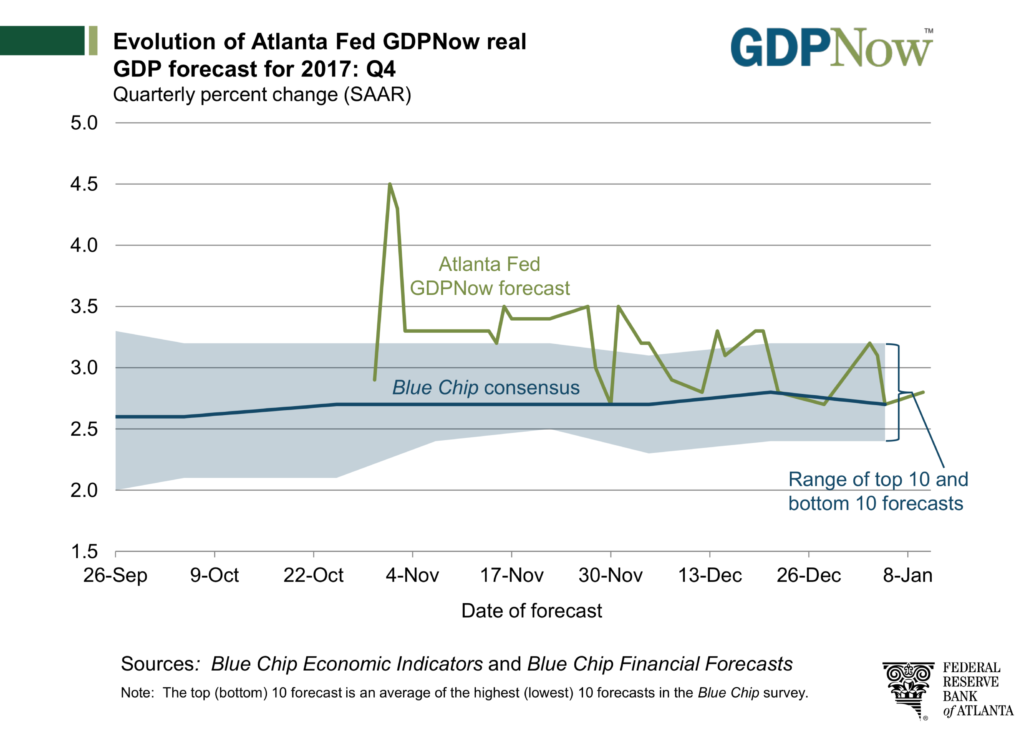

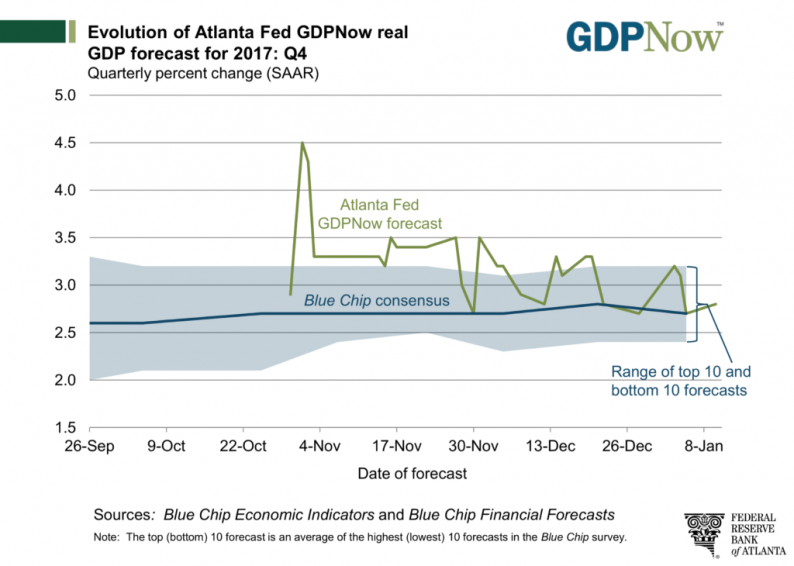

Since entering 2018, we’ve witnessed a modest drop in the Atlanta Fed’s GDP Now forecast for 4Q 2017 to 2.8% from 3.2%, primarily due to weaker than expected December auto sales and employment reports.

These reports have led to a tapering off in the Citibank Economic Surprise Index (CESI), which had been on the rise and well into positive territory exiting 2017. For those unfamiliar with the CESI, it shows how economic data are progressing relative to the consensus forecasts of market economists. A positive reading of the Economic Surprise Index suggests that economic releases have on balance been beating consensus expectations.

On the economic data schedule this week are several additional key pieces of data that will factor into 4Q 2017 GDP, namely the December figures for Industrial Production and Housing Starts. Over the last few months, we’ve seen a pick up in both single family housing permits as well as single family housing starts. Given the geographic breakdown, some of this upswing in activity can be attributed to post-hurricane rebuilding, but another likely factor could be homebuilders looking to cash in on the continued rise in new home prices given the limited supply of homes for sale over the last several quarters.

Turning to the December Industrial Production report, excluding the impact of the post-hurricane rebound in oil and gas extraction in the Texas region, industrial production was flat in November. With November’s Capacity Utilization reading of 77.1%, we continue to question the willingness of businesses to invest in property, plant and equipment given the degree of excess manufacturing capacity. In assessing the December data, we’ll be looking to see if there is a meaningful increase in capacity utilization. If not, we’ll see it as building our case that 2018 GDP is not likely to receive as big a tax reform boost as some are calling for.

Leave A Comment