In the August 2017 edition of the Market Overview, we analyzed the hawkish turn among major central banks. We pointed out that “Europe has recently been among the most surprising positive economic regions in the world”, which should induce the ECB to taper its quantitative easing program in the fall, supporting both the EUR/USD exchange rate and the price of gold. This is exactly what happened. The dollar lost more than 3 percent in 2018 against the euro, while gold jumped above $1,350 (as of January 25). As we noted in the previous edition of the Market Overview, “the beginning of the year is usually a good period for the gold prices.”

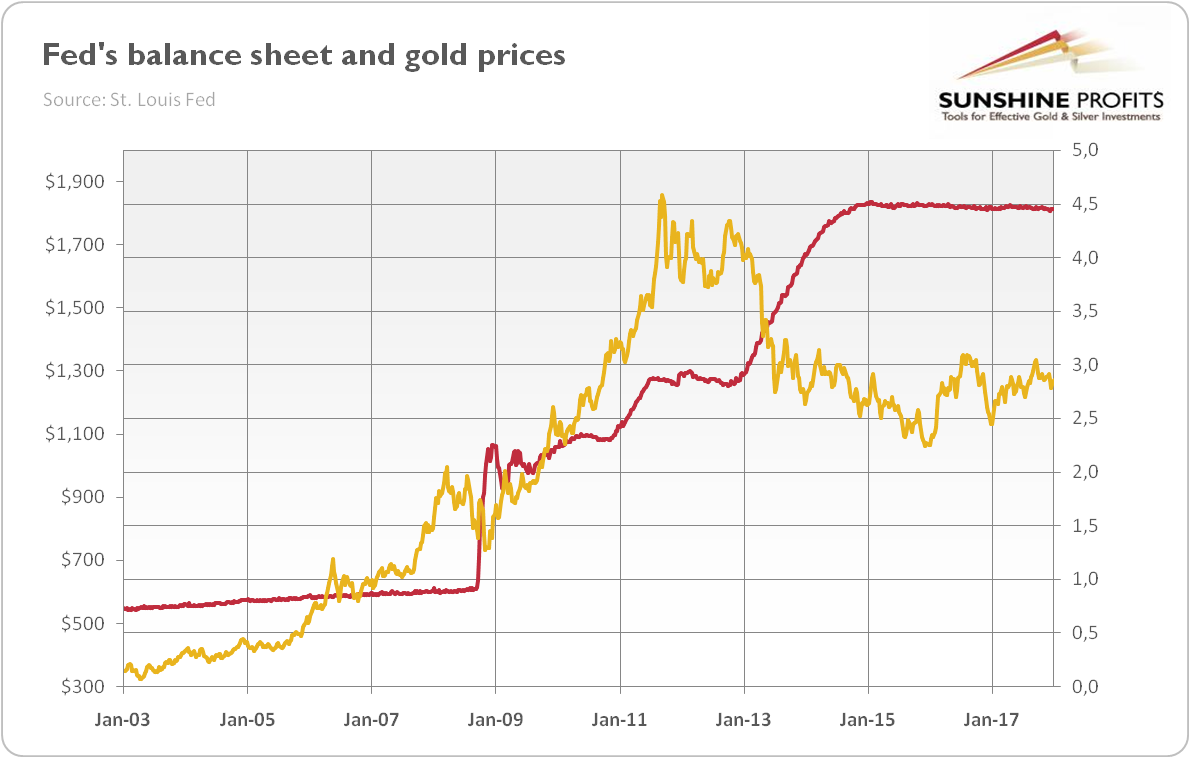

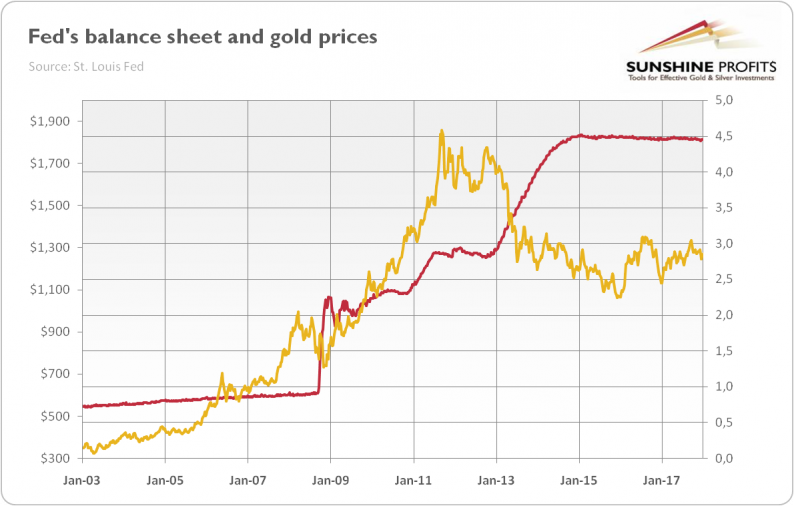

And the best might be yet to come. Why? The answer is: the Great Unwind. In the last few years, the Fed was the only hawk in town. When the majority of leading central banks remained very accommodative, the U.S. central bank heroically raised interest rates and started to unwind its balance sheet in a lonely struggle for the normalization of monetary policy. The chart below doesn’t show a significant reduction, but we see that the amount of the Fed’s assets remained roughly stable since 2015 and started slightly declining recently.

Chart 1: Fed’s balance sheet (red line, right axis, in trillion of $) and the gold prices (yellow line, left axis, London P.M. Fix, in $) from 2013 to 2017.

Now, with strong economic momentum in Europe and with the Bank of Japan saying that it would buy fewer long-term bonds, the situation is completely different. Or maybe not, but the investors’ expectations changed. And conjectures based on hopes and fears are what drive the markets. So let’s look at the premises behind these beliefs.

First, the growing economic recovery in the Eurozone spurs investors to believe that the ECB will tighten its monetary policy sooner rather than later. The minutes from the December 2017 meeting added fuel to the fire, as investors could read that “members expressed confidence that the euro area economic recovery had now moved into expansionary territory”, which “increased the level of confidence in a sustained return of inflation towards the Governing Council’s aim”. Ten yards for euro bulls.

Leave A Comment